Do cheap interest rates equate to smart finance structures?

We all understand that buying cheap does not always equate to the best value purchase but when it comes to finance, the interest rate is often the primary focus and this can lead to poor customer outcomes. This is because finance can be complex and other more important factors like structure, terms and conditions can have a much greater impact on cash flow than interest rate.

It’s very common to see businesses with cash flow issues that have poor asset finance structures as the primary cause for this. This is because it is now hard for Customers to make a value judgement when choosing a finance provider as finance has become a commoditized product where the interest rate is the perceived point of differentiation.

Valentine's Gifts

A collection of rare and fabulous books just arrived at the Red Cross Shop K Road! The perfect gift for your lover this Valentine's Day 💘

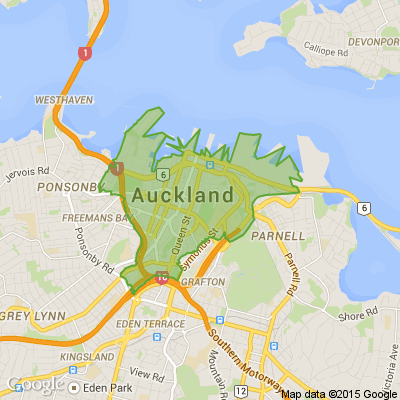

📍191 Karangahape Road, Auckland Central

🕐 Mon-Sun: 9.00am to 5.30pm

📞 093778072

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.3% For. Self-service is less frustrating and convenient.

-

43.5% I want to be able to choose.

-

47.2% Against. I want to deal with people.

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…