Retirement savings gap emerging between self-employed and employees

A joint report from the Retirement Commission and accounting firm Hnry called Improving the retirement savings of the self-employed, found self-employed workers contribute to KiwiSaver at less than half the rate of employees, with many missing out on Government contributions.

Only 44% of self-employed Kiwis actively contribute to KiwiSaver, compared to 78% of employees between April 2024 and March 2025, according to the report.

Meanwhile, 41% of self-employed KiwiSaver members receive no government contribution, often due to irregular income or low earnings.

“Self-employed New Zealanders make up a growing share of our workforce, yet they are being left behind when it comes to retirement savings,” Retirement Commissioner Jane Wrightson said.

“Without meaningful reform, we risk seeing hundreds of thousands of people reach retirement without sufficient financial security.”

This could leave more retirees relying heavily on Government transfers – such as NZ Super and other benefits – as well as other public support, Wrightson said.

“Today’s inaction could become tomorrow’s fiscal burden.”

According to the 2023 Census, New Zealand has more than 420,000 self-employed individuals.

However, recent changes to KiwiSaver announced in this year’s Budget could further diminish retirement savings for self-employed.

From July 1, the Government’s contribution was reduced from 50c for every $1 to 25 cents for every $1 contributed up to $260.72.

The report said the policy change will reduce the retirement savings of self-employed KiwiSaver members, as they face the reduction in the Government contribution with no increase in employer contributions to offset this.

Hnry’s Sole Trader Pulse survey, commissioned two weeks after the Budget, found 24% of sole traders said they would reduce their KiwiSaver contributions because of Budget 2025 policy changes.

A further 6% said they would stop contributing to KiwiSaver altogether.

James Fuller, Hnry chief executive, said retirement savings must work for all New Zealanders, regardless of how they earn their income.

“Right now, we have a two-tier system that favours employees.

“Sole traders face a very real risk of poverty in retirement unless there is a cross-party consensus and policies that help them save more.

“We hope these findings finally lead the Government and Parliament to take this issue seriously.”

The report outlined policy options to improve outcomes for the self-employed based on initiatives already in place in other OECD nations, including:

Flexible percentage-of-income contributions;

Enhanced incentives for low-income contributors;

Innovative savings products such as linked emergency and retirement accounts.

===================================================

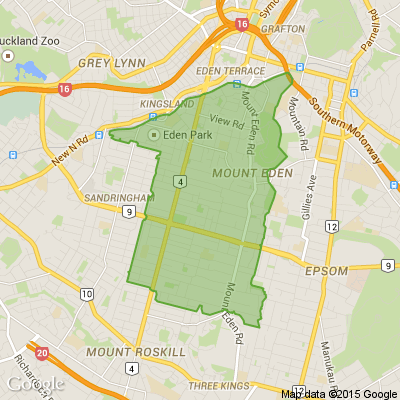

Dry cleaners mt Roskill

Hello our fellow neighbors I was hoping someone would know where the old dry cleaners we had up at the lights on dominion road have moved to?? I was out of town and when I came back they were gone .... I had some items that I would really love to get back but if only I new where they moved to or how to get In Touch with the owners to see what they did with our clothes if they closed down or moved elsewhere? Any updates or news about it would be amazing neighbors. Have a great day

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.4% For. Self-service is less frustrating and convenient.

-

43.5% I want to be able to choose.

-

47.1% Against. I want to deal with people.

New BEGINNERS LINEDANCING CLASS

Epsom Methodist church

12 pah Rd GREENWOODS cnr. Epsom

Monday 9th February 7pm - 9pm

Tuesday 10th February 10am -11am

Just turn up on the day

Loading…

Loading…