Main Home Exemptions

Hi again

Exemption for your main home under the bright line tax is full of fish hooks .

One example is:

Often clients assume because they are “now living in it” their home (previously rented) is exempt.

When using Trusts the main home exemption rules can be blurred. It is very important you check with your Tax Advisor so that settlement on sale or purchase happens correctly. Done incorrectly there are significant taxation liabilities.

If you would like some independent advice or need an Accountant please call us.

Phone: 095280069

www.Westons.co.nz...

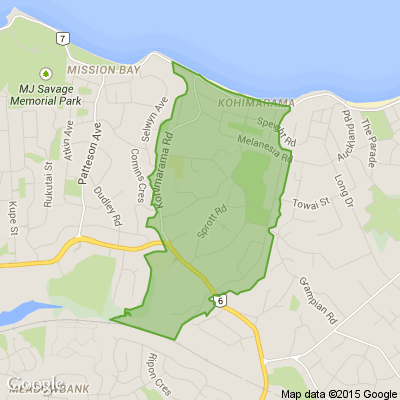

Sunday Lawn Bowls

We are stretching out summer vibes with social Sunday lawn bowls in Kohimarama. Come hang out at ours!

Denim, but make it one-of-a-kind 💙

Not every pair of jeans makes it to the rack... but that doesn’t mean their story ends there. Our talented volunteer Annie has been transforming damaged denim into handcrafted bags, hats and aprons in our Onehunga SPCA Op Shop ✂️🧵

This latest batch even features her own hand-sewn designs, and customers have been loving them, they sell almost as soon as they hit the shelf!

It’s creativity, sustainability and community all stitched together, helping animals in need 🐾

📍 217 Onehunga Mall, Onehunga

🕘 9am–5pm, 7 days

Poll: Is Auckland’s economy improving?

The latest reporting from The Post suggests a wave of optimism for 2026. With interest rates finally heading south, businesses are feeling more positive. But for many on the ground, the real-world recovery feels a bit like a slow-moving commute on Auckland's motorways.

We want to know: Are you seeing signs of Auckland's economy improving in your industry or neighbourhood? Whether it's busier shops, new projects kicking off, or just a shift in the mood ...

-

0% Yes

-

57.1% No

-

42.9% A little

Loading…

Loading…