Council whitebait debt: ‘We’re not a benevolent society here’

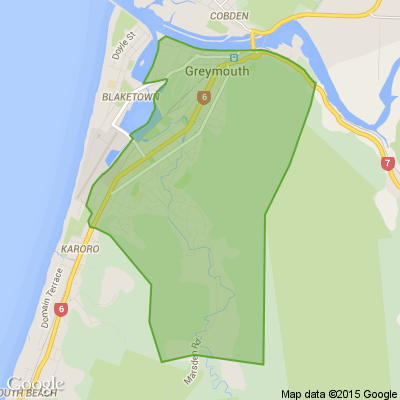

Some of the West Coast's 650 whitebait stand holders owe the West Coast Regional Council for failing to pay their consent fees.

The matter came up as the council discussed its new policy to address non-rates aged receivable debt.

Council chairperson Peter Haddock said the combined whitebait debt more than three months old owed by standholders was unacceptable.

"We've got white-baiter debtors of $40,000-plus. I would have thought if you don't pay your licence, there is no licence.

"We're not a benevolent society here," Haddock said on March 5.

At the end of January, the council had $1.55 million in outstanding debt of more than 30 days old.

Of that, whitebait stand-holders collectively owed $44,076 of unpaid fees for 90 days or more.

This is despite whitebait stands on West Coast rivers being in hot demand and lucrative for holders in good years.

Individuals can in a good season earn tens of thousands of dollars from selling the delicacy.

Many stands have are held inter-generationally, with their right to keep it a recreational activity fiercely defended in recent years.

Council charges West Coast whitebait standholders an annual resource consent monitoring fee of $201.25.

The fees are usually invoiced in July each year.

Whitebait stand consent holders must also pay an annual administration charge of $115 for each individual whitebait stand consent file held.

Councillor Brett Cummings said whitebait and also gravel take debtors should have their privileges withheld.

"If they are not paying their gravel or whitebait fees, they should be removed."

Chief executive Darryl Lew said council was legally unable to withdraw a consent on the basis of non-payment.

However, acting consents and compliance manager Chris Barnes said it could for whitebait standholders.

Councillor Peter Ewen said the overall $1.55m debt currently owed to the council affected the financial bottom line.

He wanted to know the quantum of debt written off annually as an impact on the rates strike.

"All this reflects on our rates strike at the end of the year - our bottom line," he said.

Other overdue debtors, by more than three months at the end of January, included $91,846 for 'sundry debtors,' $133,856 for 'work order' debt, and overdue gravel compliance monitoring fees of $66,735.

Cummings said the debt backlog was unsettling.

"It's scary. You wouldn't run a business like this."

Councillor Frank Dooley said the council had to be highly active about debt collecting, although its new policy adopted in November had seen $100,887 recovered in one month.

Ewen said a significant problem for the council was payment for work funded by Government departments, which took time to flow through.

He said the 'aged debt' breakdown presented to the meeting should be itemised by sector so it was transparent who owed what.

"I would like to know what the Crown's outstanding debt is."

Lew said most of the Government agency payment debt was to do with the council's infrastructure programme via Kanoa.

Following negotiations recently it was now "proactively paying us ahead of time".

"We're not effectively bankrolling these things any more.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.5% Yes, supporting people is important!

-

26% No, individuals should take responsibility

-

14.5% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Loading…

Loading…