Poll: What are the living costs that are having the biggest (and perhaps surprising) impact on your wallet?

Butter, power bills, and those sneaky surcharges on your card ... it feels like everything’s creeping up in price lately. We’ve seen the headlines, but we want to hear it from you.

Overall, Most Kiwis say they’re ‘not prospering’. But, according to Retirement Commission data, some members of our community (women, Māori, and Pacific people) are experiencing worsening financial positions at elevated rates.

Stats NZ tells us that food prices have jumped 4.6% since this time last year, with meat and dairy doing most of the damage. This jump is hitting us all, but groceries are just one part of the picture.

When basic costs keep climbing, the old cost-saving tricks — like bulk-buying or stockpiling on sale — don’t always work. Who can afford to spend more upfront when every dollar already has a job?

We want to know: What costs have caught you off guard the most? What are the expenses that feel impossible to juggle right now?

Share your thoughts below!

-

43.5% Grocery bills

-

33% Utilities

-

1% Your treats (the ones that keep you human day to day, and are ESSENTIAL!)

-

0.1% Education

-

7.6% Healthcare

-

1.3% Travel (public transport/petrol)

-

7.9% Rent or mortgage

-

1.5% Social costs: birthday gifts and occasions

-

4.1% Other - share below!

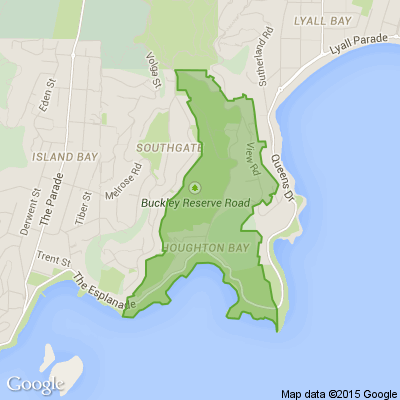

Seatoun Staying Safe Refresher Driving Course with Age Concern Wellington -25th Feb

Staying Safe is a classroom-based refresher workshop for senior road users. Age Concern runs these workshops in partnership with Waka Kotahi (NZTA).

The workshop aims to maintain and improve safe driving practices and increase the knowledge of other transport options available to help senior road users remain safely mobile.

The free interactive workshop runs for around 4 hours from 10am to around 2pm (sometimes finishes earlier) on Wednesday 25th Feb.

Morning tea and a light lunch provided.

Spaces at each workshop are limited so please register using the website link below or call us 04 4996646.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.5% Yes, supporting people is important!

-

26.1% No, individuals should take responsibility

-

14.4% ... It is complicated

Brain Teaser of the Day 🧠✨ Can You Solve It? 🤔💬

Make a hearty dish. Take just half a minute. Add four parts of kestrel. Then just add one. What have you made?

(Trev from Silverdale kindly provided this head-scratcher ... thanks, Trev!)

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…