Managing the impact of rising costs in your home 🏡

In the face of escalating living expenses, implementing strategies to stretch your dollar becomes crucial. Small savings across various aspects of your life can accumulate into significant financial relief. Let’s explore effective ways to manage the impact of rising costs in your home.

Start by scrutinising your home loan. Amidst increasing interest rates, reviewing your home loan is a prudent step. Beyond the interest rate, consider factors like the loan term, home equity, and how well the loan aligns with your financial goals. This assessment may unearth opportunities to save money and better align your loan with your future objectives. 💸

Examine substantial expenses such as memberships, subscriptions, and recurring costs. Evaluating these expenditures might reveal opportunities to switch to annual payments or temporarily scale back to optimise your budget.

Pooling resources with friends for streaming services is a smart move. Assess your subscriptions and contemplate sharing multi-screen services with friends to make efficient use of your entertainment budget. 📺

Trimming expenses on takeaways is another impactful measure. While convenient, frequent takeaways can strain your disposable income. 🍔 Consider deleting food delivery apps to reduce temptation and explore home-cooked ‘fakeaway’ alternatives for everyday meals, reserving the real deal for special occasions.

Crafting a meal plan can significantly impact your budget. Plan your meals for the week, including snacks and desserts, and cook extra servings for leftovers. This disciplined approach reduces reliance on takeaways during low-energy evenings.

Opt for online grocery shopping to adhere to your meal plan and avoid overspending. Be aware of the day supermarkets update their specials, on say Wednesdays. Make use of your Gold Card at the supermarkets who encourage its use, making it an ideal day to shop and capitalise on new offers.

Energy costs often go unnoticed, but comparing providers and switching to a more economical deal can yield substantial savings. 💡 Leverage your local government’s comparison website to assess providers against your usage rate. Some companies may even offer rebates for comparing and switching.

After optimising your energy costs, implement energy-saving practices. Make small adjustments, such as turning off heaters and appliances when not in use. Consider using fans instead of air conditioners and smaller space heaters to reduce overall heating expenses. An electric blanket can provide warmth on cooler nights without increasing your heating costs.

Review and refine how you organise your finances. Compartmentalise your savings and discretionary spending categories to stay on top of your priorities. Placing non-essential savings in an account with limited access can discourage unnecessary expenditures.

In times of rising fuel prices, comparing petrol costs becomes essential. Apps like Gaspy enable you to find the lowest prices in your area, helping you save on fuel expenses. ⛽️

As interest rates fluctuate, it’s an opportune moment to reassess your financial situation.

Good luck !

Contact me for more real estate tips 0274 951 536 📱

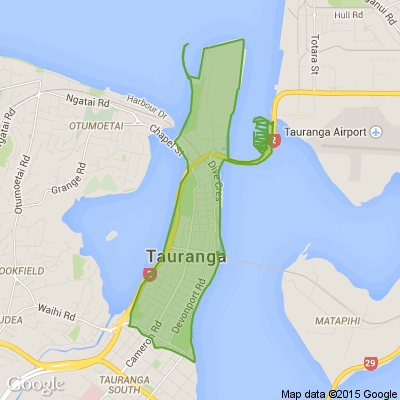

#realestatetips #mattwineerarealestate #tauranga

🧩😏 Riddle me this, Neighbours…

I am an odd number. Take away a letter and I become even. What number am I?

Do you think you know the answer?

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Step by step for a great cause!

Our amazing Hillary Hikers from Edmund Hillary Village showed their support for Bowel Cancer New Zealand's Move Your Butt campaign this month!

Sporting the bright purple and orange campaign shirts, these wonderful walkers hit the Auckland waterfront and marched from Mission Bay to Kohimarama, raising awareness for bowel cancer and the importance of early detection along the way.

Click read more to read the full story.

Loading…

Loading…