Buying a Home? Take a Breath — You’ve Got This 🏡✨

If you’ve started doing a bit of research online, chances are you’ve come across this line:

“Buying a home is one of the biggest investments you’ll ever make.”

It’s everywhere. And while it is true, it can also feel a bit... overwhelming. Like, no pressure, right?

But here’s the thing — yes, buying a home is a significant financial decision, but it’s also so much more than just numbers. You’re not just investing in property — you’re choosing a space to live your life, to create memories, to feel safe and settled. This is about building your future, not just your portfolio.

Feeling a little panicky is totally normal — but there are some simple steps that can help you move forward with confidence:

✨ Learn as much as you can about the process

✨ Get yourself prepared ahead of time

✨ Take it one step at a time — in the right order

And the best part? You don’t have to do it alone. A knowledgeable, local real estate agent (👋 hello!) can walk beside you from start to finish, helping you make sense of everything and keeping it all on track.

This is your journey — let’s make it a good one. 🏠💛

✅ Step 1: Financial Foundations

• Check your credit score

• Fix any issues on your credit report

• Start saving for:

o Deposit (usually 10–20% of the purchase price)

o Additional costs:

* LIM Report

* Builders Report

* Registered Valuation

* Lawyer’s fees

* Moving costs

• Talk to your bank and a mortgage broker

• Apply for mortgage preapproval from multiple lenders

• Compare interest rates, terms, and loan features

✅ Step 2: Define Your Dream Home

• Set your budget based on preapproval

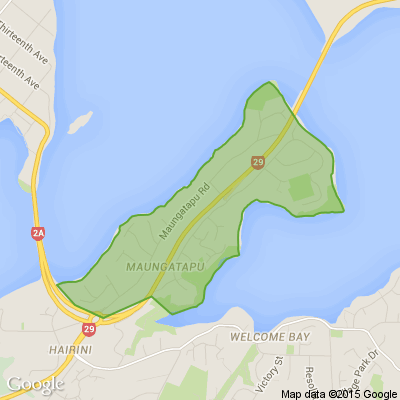

• Choose your preferred Tauranga suburbs (e.g., Bethlehem, Papamoa, The Lakes, Otumoetai, Mt Maunganui etc)

• Create a list of:

o Must-haves (e.g. 3 bedrooms, double garage, close to schools)

o Nice-to-haves (e.g. sea view, home office, big backyard)

• Prioritise your list

• Share your wishlist with your real estate agent

✅ Step 3: Choose the Right Agent

• Talk to at least two or three local agents

• Ask about their experience in your target areas

• Pay attention to:

o Communication style

o Local knowledge

o Whether they listen to your needs

o If you feel comfortable with them

✅ Step 4: Get Informed

• Ask your agent for blank copies of the forms you’ll be signing

• Learn the process of:

o Making an offer

o Conditional vs. unconditional contracts

o Settlement day

• Ask questions about anything you don’t understand

• Keep your paperwork organised

✅ Extra Tips

• Stay flexible- perfect homes rarely exist, but the right one will feel right

• Keep emotions in check during negotiations

• Don’t skip due diligence—even if the home looks great

• Celebrate each step—you’re making progress!

For more info contact me for no obligation advice.

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Share your favourite main crop potato recipe and win a copy of our mag!

Love potatoes? We will give away free copies of the May 2026 issue to readers whose potato recipes are used in our magazine. To be in the running, make sure you email your family's favourite way to enjoy potatoes: mailbox@nzgardener.co.nz, by March 1, 2026.

Poll: 🤖 What skills do you think give a CV the ultimate edge in a robot-filled workplace?

The Reserve Bank has shared some pretty blunt advice: there’s no such thing as a “safe” job anymore 🛟😑

Robots are stepping into repetitive roles in factories, plants and warehouses. AI is taking care of the admin tasks that once filled many mid-level office jobs.

We want to know: As the world evolves, what skills do you think give a CV the ultimate edge in a robot-filled workplace?

Want to read more? The Press has you covered!

-

52.7% Human-centred experience and communication

-

14.8% Critical thinking

-

29.8% Resilience and adaptability

-

2.7% Other - I will share below!

Loading…

Loading…