Buying a Home? Take a Breath — You’ve Got This 🏡✨

If you’ve started doing a bit of research online, chances are you’ve come across this line:

“Buying a home is one of the biggest investments you’ll ever make.”

It’s everywhere. And while it is true, it can also feel a bit... overwhelming. Like, no pressure, right?

But here’s the thing — yes, buying a home is a significant financial decision, but it’s also so much more than just numbers. You’re not just investing in property — you’re choosing a space to live your life, to create memories, to feel safe and settled. This is about building your future, not just your portfolio.

Feeling a little panicky is totally normal — but there are some simple steps that can help you move forward with confidence:

✨ Learn as much as you can about the process

✨ Get yourself prepared ahead of time

✨ Take it one step at a time — in the right order

And the best part? You don’t have to do it alone. A knowledgeable, local real estate agent (👋 hello!) can walk beside you from start to finish, helping you make sense of everything and keeping it all on track.

This is your journey — let’s make it a good one. 🏠💛

✅ Step 1: Financial Foundations

• Check your credit score

• Fix any issues on your credit report

• Start saving for:

o Deposit (usually 10–20% of the purchase price)

o Additional costs:

* LIM Report

* Builders Report

* Registered Valuation

* Lawyer’s fees

* Moving costs

• Talk to your bank and a mortgage broker

• Apply for mortgage preapproval from multiple lenders

• Compare interest rates, terms, and loan features

✅ Step 2: Define Your Dream Home

• Set your budget based on preapproval

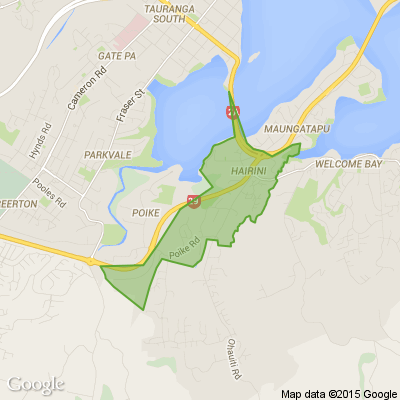

• Choose your preferred Tauranga suburbs (e.g., Bethlehem, Papamoa, The Lakes, Otumoetai, Mt Maunganui etc)

• Create a list of:

o Must-haves (e.g. 3 bedrooms, double garage, close to schools)

o Nice-to-haves (e.g. sea view, home office, big backyard)

• Prioritise your list

• Share your wishlist with your real estate agent

✅ Step 3: Choose the Right Agent

• Talk to at least two or three local agents

• Ask about their experience in your target areas

• Pay attention to:

o Communication style

o Local knowledge

o Whether they listen to your needs

o If you feel comfortable with them

✅ Step 4: Get Informed

• Ask your agent for blank copies of the forms you’ll be signing

• Learn the process of:

o Making an offer

o Conditional vs. unconditional contracts

o Settlement day

• Ask questions about anything you don’t understand

• Keep your paperwork organised

✅ Extra Tips

• Stay flexible- perfect homes rarely exist, but the right one will feel right

• Keep emotions in check during negotiations

• Don’t skip due diligence—even if the home looks great

• Celebrate each step—you’re making progress!

For more info contact me for no obligation advice.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.8% Yes, supporting people is important!

-

25.9% No, individuals should take responsibility

-

14.4% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Loading…

Loading…