Half of ratepayers received wrong rates bills from West Coast Regional Council

By local democracy reporter Brendon McMahon:

About half of West Coast Regional Council rates bills were incorrectly charged.

The council on Wednesday announced PricewaterhouseCooper has completed an external review into the first installment rates mess.

The review found "outdated" capital valuation figures were behind significant inaccuracies in about 50% - about 11,000 - of the bills sent by council early this month to its 22,000 property rating base.

Chief executive Darryl Lew again apologised on behalf of council for the mess.

It follows ratepayers being shocked at opening their bills early this month to find increases of anywhere up to 100%.

The council passed a general rates rise of 16.4% in June.

Lew said he would initiate a further audit to determine what went wrong and to ensure it did not happen again.

Almost all of the main towns on the West Coast were affected, apart from Reefton.

The capital values used to calculate the factors in the rates strike for each special rating district had been based on "outdated capital value figures", Lew said.

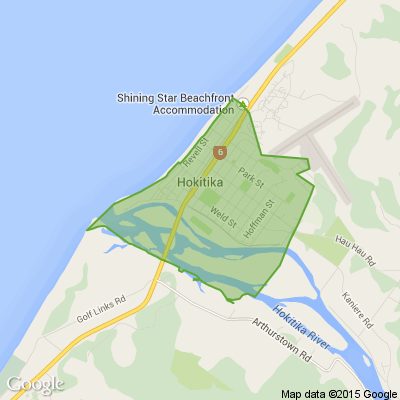

The largest variations were found in Greymouth, Punakaiki, Westport, Karamea, Hokitika, Red Jacks (Grey Valley) and Wanganui (Hari Hari) special rating districts.

"The review also found rates variations in the Grey Rating District have resulted from the Grey Floodwall Rating District Boundary extension and the capital value of property within this area."

PricewaterhouseCooper identified the "underlying variations" that affected a number of rates notices, Lew said.

"I am now initiating an audit to determine what went wrong in council's procedures to ensure future controls are put in place that will prevent this happening again."

On October 20, the council announced a further extension of the 2023-24 first rates installment due date, to Thursday November 30.

The council had also now reviewed the levies for the affected areas with the correct capital valuations and would be raising "credit notes" for each of the properties concerned.

Lew apologised for the inconvenience of the resulting "rates corrections".

He urged those unsure if their property had been rated correctly to contact the council office.

Those who had already paid their rates for the year in full could ask council for a refund.

Lew said the council would ensure staff efficiently created rates credit notes.

"Ratepayers in the affected areas will receive a letter in due course stating what they have been charged for the first rates demand, a breakdown of their current rating assessment and advice on the correct amount to pay."

The second rates demand would only charge the difference between the first and second rates installment and would therefore be a lower amount to pay.

Lew said repayment plan options were also available for those affected by variations, due to the wrong capital value being used in the first place.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.6% Yes, supporting people is important!

-

25.9% No, individuals should take responsibility

-

14.5% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Loading…

Loading…