Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Canterbury's Surface Prep & Coating Specialists

Blasting, zinc arc spraying, and industrial painting – done right. Mild steel, stainless, and alloy treatments. Book a site visit!

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Are you looking for a chance to give back to your community and support victims of crime and trauma in Canterbury?

Victim Support volunteers are people who give up some of their time each week to provide support and information to people affected by crime and tragedy.

Hear Tracy, Paul , … View moreAre you looking for a chance to give back to your community and support victims of crime and trauma in Canterbury?

Victim Support volunteers are people who give up some of their time each week to provide support and information to people affected by crime and tragedy.

Hear Tracy, Paul , Apoorva and Karen talk about their volunteering experience or find out more now at victimsupport.org.nz

April - Canterbury Area Manager

Learn more

The Team from Addictive Eaters Anonymous - Christchurch

Monthly AEA web events are held on the third Saturday (Greenwich Mean Time) of each month.

For March it is 9am Sunday (NZ time).

For newcomers interested in receiving a Zoom invitation for the event, please email aeawebevent@gmail.com.

Damon from Yaldhurst

Hi all my name is Damon I run my own very diverse Decorating business here in Christchurch and have done so for the last 15 years.

If you would like to view my work please look up trowel services Ltd on Facebook take care

Damon

Loving this heat?? Anna is!! Len is busy quoting in the office. Anna is in the office keeping the on top of the admin. Lucky for them... air con!! Not so lucky for Shanan and Louis who will be out in this heat!

The Team from

Making the decision to move into a retirement village can be a daunting experience. With so many things to consider, we want to make the process a little easier.

Visiting a village is the best way to obtain a true appreciation of what life will be like, take in the sights and sounds, and observe… View moreMaking the decision to move into a retirement village can be a daunting experience. With so many things to consider, we want to make the process a little easier.

Visiting a village is the best way to obtain a true appreciation of what life will be like, take in the sights and sounds, and observe the general atmosphere. Find out why Bill and Leonie from Jane Mander Retirement Village in Whangerei, found the support and care they needed from the village community.

Find out more

The Team from Neighbourly.co.nz

A radical overhaul of Christchurch's school network will see all of the city's state secondary schools zoned.

A seven-year project by local principals and boards of trustees to manage enrolments across the city culminated in an announcement on Monday that seven schools – Burnside … View moreA radical overhaul of Christchurch's school network will see all of the city's state secondary schools zoned.

A seven-year project by local principals and boards of trustees to manage enrolments across the city culminated in an announcement on Monday that seven schools – Burnside High, Hillmorton High, Mairehau High, Papanui High, Riccarton High School, Linwood College, and Haeata Community Campus – will amend or implement their enrolment zones. Keep updated here

Nicole Mathewson Reporter from The Press

The way you parent has little effect on post-traumatic stress your children may be experiencing, research shows.

University of Canterbury researcher Dr Kathleen Liberty says parenting styles account for about 2 to 5 per cent of the variance in childhood post-traumatic stress disorder.

This … View moreThe way you parent has little effect on post-traumatic stress your children may be experiencing, research shows.

University of Canterbury researcher Dr Kathleen Liberty says parenting styles account for about 2 to 5 per cent of the variance in childhood post-traumatic stress disorder.

This knowledge should reassure parents who believe their children's trauma and anxiety arises from the stress the Canterbury earthquakes have placed on many families, and remind schools dealing with quake-affected children not to engage in "parent shaming", Liberty says.

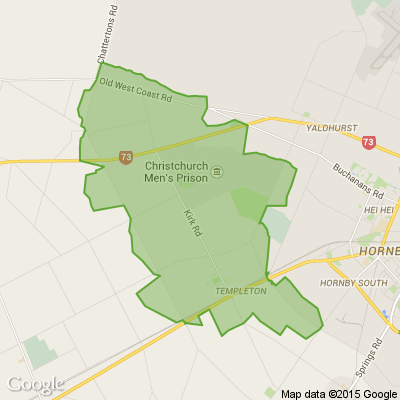

The Team from Christchurch City Council

Consultation has begun on whether the Reserve Act classification on Kyle Park should be changed to allow new community facilities to be built on the site.

Christchurch City Council wants to use part of Kyle Park to build the new Hornby library, customer services and leisure centre.

However, the … View moreConsultation has begun on whether the Reserve Act classification on Kyle Park should be changed to allow new community facilities to be built on the site.

Christchurch City Council wants to use part of Kyle Park to build the new Hornby library, customer services and leisure centre.

However, the Kyle Park Management Plan and the reserve classification of the park need to change before any development can occur there.

The changes, if approved, will only apply to the north-east corner of the park, adjacent to Waterloo Road and Smarts Road.

The public have until Monday 15 April to make submissions on the proposed changes.

Anna Williams Reporter from The Press

Canterbury's top police boss has directed all frontline officers in the region to be armed after a street shoot-out.

117 replies (Members only)

Lesley from Halswell

Reel is 18" (450 mm) wide. Tecumseh 3.0 hp, 4 stroke engine. Made in NZ by Steelfort Engineering.

Shed stored, cuts well.

This mower deserves a larger lawn than we have now.

Price: $50

The Team from KidsCan Charitable Trust

In our own backyard, our youngest kids are going without the basics. Unlike schools, early childhood centres don’t have a nationwide support programme. Children under 5 are at the most crucial age for brain development.

But KidsCan is helping. Since October they've been delivering five … View moreIn our own backyard, our youngest kids are going without the basics. Unlike schools, early childhood centres don’t have a nationwide support programme. Children under 5 are at the most crucial age for brain development.

But KidsCan is helping. Since October they've been delivering five fresh meals a week to 25 early childhood centres, and kitting out kids with new raincoats and shoes. They want to extend the programme, so no one misses out on learning.

KidsCan, Neighbourly and Stuff have partnered up to raise enough money to feed and clothe 1000 more children under five. To support a child, sign up at KidsCan.org.nz.

Donate now

Mei Leng Wong Reporter from NZ Gardener & Get Growing

Begonia specialist Graham Milne has also gone on to develop and breed one of the largest collections of tuberous begonias in the country.

Thank you New Zealand! We had hundreds of wonderful entries for the very first Resene Loveliest Letterbox competition...but we now need your help to decide our four winners.

Four wonderful neighbours who submitted these entries will win a $500 prize - a $250 Prezzy® card and a $250 Resene … View moreThank you New Zealand! We had hundreds of wonderful entries for the very first Resene Loveliest Letterbox competition...but we now need your help to decide our four winners.

Four wonderful neighbours who submitted these entries will win a $500 prize - a $250 Prezzy® card and a $250 Resene voucher - and so will the owner of the letterbox! Please help us decide our winners.

Tell is which letterbox is your favourite. CLICK HERE to vote now!

Vote now

The Team from Christchurch City Council

Come along to The Organics Plant Open Day and find out how our green waste gets processed. Don't forget to bring the kids!

Mei Leng Wong Reporter from NZ Gardener & Get Growing

Begonia specialist Graham Milne has also gone on to develop and breed one of the largest collections of tuberous begonias in the country.

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2026