Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Auckland Seniors & Travel Expo

Be in to win a Luxury Beachfront Escape for Two to Rarotonga. North Harbour Stadium 28 February & 1 March 10:00am – 3:00pm

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Paul Bishop from VIP CONCRETE

A concrete driveway is a prominent feature at the entrance

of your home.

If your driveway is in good shape it has a higher perceived value as well as actual value - of up to 10% increase to your home. If considering selling in the future, buyers will compare your house to others as part of their … View moreA concrete driveway is a prominent feature at the entrance

of your home.

If your driveway is in good shape it has a higher perceived value as well as actual value - of up to 10% increase to your home. If considering selling in the future, buyers will compare your house to others as part of their due diligence.

Driveways are very practical too – bike riding, push chair and wheel chair access. Kids can play ball games and it can be used as BBQ area.

A vehicle parked in the driveway helps to protect it from vandals that normally lurk on the street walks at night. (like a possum, but with bad intentions).

Think about the insurance discount the insurance company will give you when you tell them your vehicle is parked off the street!

Any investment into the driveway you will get back, and some.

info@vipconcrete.co.nz

www.vipconcrete.co.nz...

022 646 7877

There is a new generation of New Zealander, seeking a new way to live in retirement. They are living their lives with passion and purpose, striving to push further, to create better, to go beyond the ordinary.

A new generation of Kiwis are not retiring from life; they’re finding a new way to … View moreThere is a new generation of New Zealander, seeking a new way to live in retirement. They are living their lives with passion and purpose, striving to push further, to create better, to go beyond the ordinary.

A new generation of Kiwis are not retiring from life; they’re finding a new way to live. One with flexibility, certainty, and the ability to dial care up and down as you need it.

Learn more

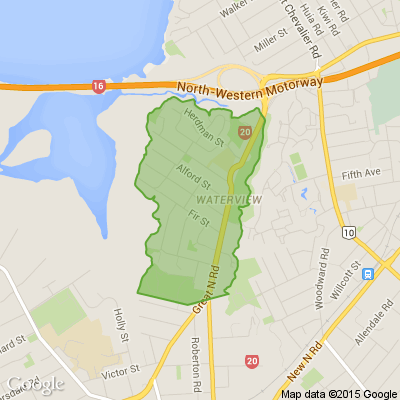

A small number of places have become available to out-of-zone students in Year 2 for enrolment in 2021. Birthdate must be between 1st April 2014 and 31st March 2015.

The closing date for out of zone applications is Wednesday 14th October.

If more applications are received than places … View moreA small number of places have become available to out-of-zone students in Year 2 for enrolment in 2021. Birthdate must be between 1st April 2014 and 31st March 2015.

The closing date for out of zone applications is Wednesday 14th October.

If more applications are received than places available, a ballot will be held on or before 21st October 2020.

To apply please head to our website.

Apply now

The Team from Auckland Council

While COVID-19 has had a big impact on plans for this year, we still have some fantastic opportunities for you to practice your reo (language) this Māori Language Week. Find out how by clicking on 'Read More' below.

42 replies (Members only)

Ripu Bhatia Reporter from Auckland Stuff

Hi neighbours,

An online military database has been translated into te reo to honour Māori servicemen and women.

Auckland War Memorial Museum has introduced the changes to the user interfaces of its online cenotaph and collections in time for Te Wiki o te Reo Māori – Māori Language Week.… View moreHi neighbours,

An online military database has been translated into te reo to honour Māori servicemen and women.

Auckland War Memorial Museum has introduced the changes to the user interfaces of its online cenotaph and collections in time for Te Wiki o te Reo Māori – Māori Language Week.

The initiative was funded by a $15,000 grant from InternetNZ, a lobby group that aims to support digital inclusion.

Rebecca from Point Chevalier

For the outdoor reclining lounger

Very good condition

Never used

Bought for the dog to lie on in the car. He didn't like the fabric

Price: $20

Rebecca from Point Chevalier

50x60

Never used dog bed.

This is a deluxe self warming dog bed designed and made in the UK

Too small for my dog.

Retails for 104 new

Price: $80

2020 has been a challenge for Adrenalin Forest Auckland, after a long winter we are ecstatic to be reopened, and give Aucklander’s something to talk about this summer!!

Adrenalin Forest Auckland is now OFFICIALLY the highest & hardest of all Adrenalin Forest locations. Level 6 will take … View more2020 has been a challenge for Adrenalin Forest Auckland, after a long winter we are ecstatic to be reopened, and give Aucklander’s something to talk about this summer!!

Adrenalin Forest Auckland is now OFFICIALLY the highest & hardest of all Adrenalin Forest locations. Level 6 will take you up to 33 metres high, and has flying foxes up to 100 metres long!

Our Auckland course features over 100 fun filled challenges across seven levels. Each level is harder than the last, with obstacles starting at 1.5 metres above the ground that are suitable for a wide range of fitness levels, and ages.

.

OUR MINIMUM HEIGHT REQUIREMENT IS 140CM FOR ALL LEVELS.

Find out more

The Team from

Are you or a loved one thinking of moving into a retirement village? The Office of the Retirement Commissioner is hosting a free, two-part webinar series on 23 and 24 September for anyone interested to help you understand the personal, legal, and financial implications. Selling the family home and… View moreAre you or a loved one thinking of moving into a retirement village? The Office of the Retirement Commissioner is hosting a free, two-part webinar series on 23 and 24 September for anyone interested to help you understand the personal, legal, and financial implications. Selling the family home and moving into a village is a big decision, so register today and let our experts guide you through what you and your family need to know so you can be sure you make the right choice.

Neeta from Mount Albert

In this pandemic situation, rules are meant to be followed, for your own safety, and if you are considerate, for others as well. Is it that hard to have some kind of face covering while travelling?

On the bus I took home this afternoon- there was a group of 4-5 passengers chatting away loudly, NONE… View moreIn this pandemic situation, rules are meant to be followed, for your own safety, and if you are considerate, for others as well. Is it that hard to have some kind of face covering while travelling?

On the bus I took home this afternoon- there was a group of 4-5 passengers chatting away loudly, NONE of them had any face coverings on. Every other passenger and the driver had it on. I just got annoyed and moved to a different seat.

Level 2.5 restrictions include mandatory face coverings on public transport, but who will monitor people who flout the rules?

AT staff are unable to do this- so is it up to the passengers to handle the situation, or just get off and take another bus perhaps? What is the immediate practical solution, before we hit a setback on the number of cases?

I might try and contact AT and see what they say, not expecting a prompt response though!

33 replies (Members only)

The Team from Neighbourly.co.nz

With Maori Language Week upon us, we've been adding a few more words to our te reo vocabulary and using them in our everyday lives.

Whether it's saying 'mōrena!' every morning to your whānau or singing some waiata in the car, share how you are incorporating te reo Māori … View moreWith Maori Language Week upon us, we've been adding a few more words to our te reo vocabulary and using them in our everyday lives.

Whether it's saying 'mōrena!' every morning to your whānau or singing some waiata in the car, share how you are incorporating te reo Māori below to go into the draw to win one of four $25 prezzy cards - let's kōrero!

144 replies (Members only)

Mei Leng Wong Reporter from NZ Gardener & Get Growing

In this week’s issue we say grow plenty of swan plants for hungry caterpillars. It’s time to sow and plant beetroot, spring clean your houseplants, let brassicas bloom for the bees, trim scraggly mint and record when fruit trees blossom.

Meet more of our favourite 2020 Houseplant Hero entrants… View moreIn this week’s issue we say grow plenty of swan plants for hungry caterpillars. It’s time to sow and plant beetroot, spring clean your houseplants, let brassicas bloom for the bees, trim scraggly mint and record when fruit trees blossom.

Meet more of our favourite 2020 Houseplant Hero entrants and upcycle an old pallet into a multipurpose tray. Plus go in the draw for Yates wildflower seeds and Manuka Doctor honey from Palmers.

Delivered every Friday to your email inbox, Get Growing digital magazine offers seasonal gardening advice from the NZ Gardener magazine's team of experts. Each week we answer all your burning questions on raising fruit and veges and tell you the top tasks to do in your backyard this weekend. Subscribe here:

RetroFit Double Glazing - Auckland Central

All you Aucklanders out there we have a special retrofit double glazing offer for you! For a limited time get 5% off and a FREE upgrade on your retrofit double glazing job. Just use the promo code: 5%+UPGRADE. Get your free no obligation quote from us now click here or call us on 0800 658 658 Terms… View moreAll you Aucklanders out there we have a special retrofit double glazing offer for you! For a limited time get 5% off and a FREE upgrade on your retrofit double glazing job. Just use the promo code: 5%+UPGRADE. Get your free no obligation quote from us now click here or call us on 0800 658 658 Terms and conditions apply click here to view offer is only available at our Retrofit Auckland and Bay of Plenty branch.

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2026