Here's what you need to know before making an offer on a house

🏠 What is the neighbourhood like?

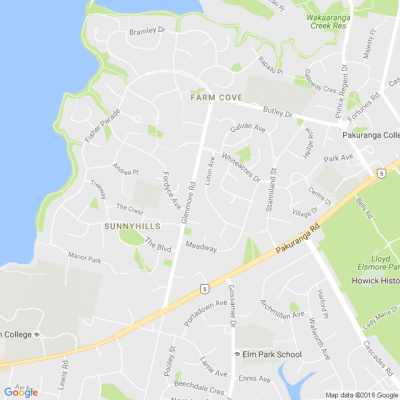

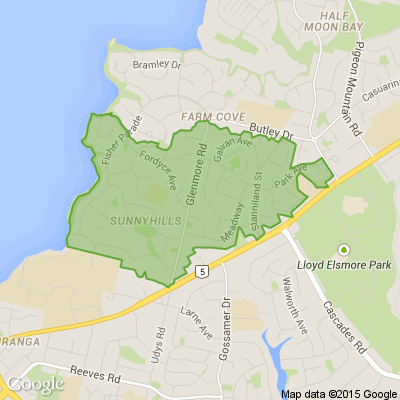

Familiarise yourself with the neighbourhood, to check accessibility to public transport, schools and shops. Visit the street at different times of day, to find out how quiet or noisy it gets. Check with the local council whether they know of any future developments in the area that could increase noise or traffic.

🏠 How much are the rates and insurance?

Do a property search on the local council’s website to see what the rates are.

You can also get quotes from insurers to find out what it might cost to insure it.

Check whether the homeowner is paying off the cost of installing insulation or heating units through their rates, because you will inherit that debt if you buy the house.

🏠 For a unit title, check the pre-contract disclosure

If the property is on a unit title development (for example, an apartment), ask to see the pre-contract disclosure. This is basic information about the unit and the unit title development.

🏠 Get a LIM (Land Information Memorandum) report

A LIM report tells you everything the local council knows about the land and the buildings, for example, what building consents and code compliance certificates they have issued for work done on the property.

🏠 Pre-purchase building inspection

Get an independent building inspector to examine the house thoroughly and look for potential problems with weather-tightness, wiring, plumbing or the foundations (piles).

Ask them to check for features that might make maintenance more difficult. For example, some types of wall claddings need specialist knowledge to maintain, access to the gutters might not be straightforward, and retaining walls can be expensive to repair.

🏠 Check the property title

Ask a lawyer or conveyancer to check the property title for things like easements. For example, an easement might allow a neighbour to access part of the property. The property title should also confirm the property boundary.

More information is on the Settled website:

www.settled.govt.nz...

Image credit: Ray White New Zealand

Info credit: Citizens Advice Bureau: cab.org.nz

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

58.6% Yes, supporting people is important!

-

25.5% No, individuals should take responsibility

-

15.8% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Night-time chipsealing works on SH2

From 9 to 17 February, stop/go traffic management will be in place on SH2 between McPherson Road and Dimmock Road on multiple nights between 9pm and 5am (Sundays to Thursdays).

During the day, all lanes will be open, but speed restrictions will apply to allow the chipseal to set and to protect vehicles travelling over the newly laid surface.

There may be delays to your journey when travelling through the area. This is weather dependent so check NZTA Journey Planner before you travel.

Loading…

Loading…