The $200,000 mistake thousands of KiwiSavers made

Thousands of KiwiSaver members who switched their investments into less risky funds when Covid-19 first hit still haven't switched back - and it could cost them hundreds of thousands of dollars.

There was a surge in switching from growth funds to conservative funds in March 2020, when sharemarkets around the world wobbled.

Westpac said it processed 18,140 requests to switch in that time.

Markets soon recovered, but 27%of those KiwiSaver members never switched back to more growth-focused assets, Westpac said.

Another 17% took more than a year to switch back and 12% switched back in between six to 12 months.

If an investor is investing for a long time - such as for retirement - growth funds often deliver better outcomes because they tend to have higher returns, although they are more volatile. Shifting from a growth fund when markets are weak can mean locking in losses.

Morningstar research shows that, as a group, conservative KiwiSaver funds have returned an average 4.1% a year over 10 years, compared to 8.2% for growth funds and 9.1% for aggressive.

Westpac projected that someone with $25,000 in KiwiSaver who switched from a growth fund to a conservative fund on March 20, 2020, would end up with $387,938 in 2054.

But if they had left their money in a growth fund, they would have $615,423 - boosting their final outcome by more than $225,000.

If they had shifted in March 2020 and then moved back a year later, they would have $588,955 in 2054.

Even over a shorter term, the impact can be seen. Someone who shifted on March 20, 2020 and left their money in a conservative fund would have $120,880 in 2034. If they shifted back after a year, they could have $145,693 and if they had not shifted, and stayed in growth, they would have $156,472.

That assumes that person is earning the median wage, getting a 3% pay rise a year, and making 3% KiwiSaver contributions matched by a 3% employer contribution.

Westpac head of KiwiSaver Nigel Jackson said the number of people who had not switched back highlighted the "education gap" for New Zealanders in relation to long-term saving and retirement.

"Being in the right fund is really important and being in the wrong fund will cost you money in the long term."

Westpac has now launched a new high-growth fund that will have 100% growth assets and Jackson said it would be important that investors understood the possibility for volatility, as well as the potential returns available, so that they could stick with it and not switch out at the wrong moment.

"It's one of those challenges, you can tell people it's going to happen but it's still a challenge for them when it does happen. It's critical they understand the possibility is there so they have the context. If they don't have the right information, that's the point of highest risk when they can lock in unrealised losses by transferring to lower-risk funds and experience that loss at retirement."

Westpac NZ general manager of product, sustainability and marketing Sarah Hearn agreed long-term investors who were not in the right fund would probably short-change themselves at retirement.

"The Covid-19 experience and more recent market fluctuations should serve as a reminder to regularly think about your investment goals, whether you're saving for retirement or a first home deposit. That includes checking you're in the right type of fund for you and your stage in life," she said.

"Market volatility is normal and expected. Those of us who aren't nearing retirement will see our balances affected by more economic peaks and troughs before we get there."

The latest Financial Markets Authority annual KiwiSaver report showed growth funds now represent 46% of total funds under management, with $51.4 billion invested, and a total of 1.53 million investors. This is more than double the $24.5b in 2021.

=============================================

www.1news.co.nz...

=============================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Yes!!!! We are open today! Waitangi Day

Red Cross Shop Dominion Road.

Come and visit us today for plenty of lovely finds…. You’ll love our $2 rack.

We are open until 5pm….looking forward to seeing you soon!

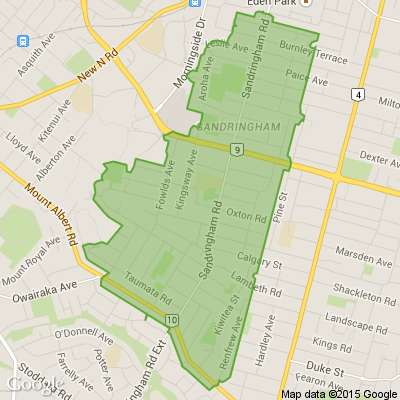

184 Dominion Road 📍

Open 7 days a week 🗓️

Mon-Sun: 9am-5pm

Free 90min parking 🅿️

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.5% For. Self-service is less frustrating and convenient.

-

43.4% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Loading…

Loading…