Persistence and Attention to Detail (Day 7)

In the serene village of Te Ao Marama, a young Māori student named Aroha was studying engineering at a renowned university in Aotearoa (New Zealand). Aroha was a dedicated learner, carrying with her the aspirations of her whānau (family) and iwi (tribe). She approached her studies with the same principles her tūpuna (ancestors) had lived by: manaakitanga (care and respect for others), kaitiakitanga (guardianship), and a commitment to excellence.

Aroha had consistently achieved high marks in her studies, always earning recognition for her hard work. But when her third-year semester results were published, Aroha was disheartened to see her grades fall to a whakamanawa noa (average pass). One course, in particular, had received unusually low marks, and she couldn’t understand why.

Instead of reacting in frustration, Aroha reflected on the teachings of her kaumātua (elders): "Kia mau ki te tūmanako” — hold on to hope. She sought advice from her peers, who told her to let it go and move forward. They warned her that challenging the system could be risky and might even result in worse outcomes.

Aroha, however, trusted her instincts. She remembered how her tupuna would pause to think carefully before making important decisions. She went to the local marae for karakia (prayer) and spent time in quiet contemplation, asking for guidance. While reflecting, she recalled that during the exam, she had used extra paper to explain her calculations. A thought struck her: what if the additional pages hadn’t been reviewed?

With renewed determination, Aroha submitted a formal request for a recount (re - totaling of her marks). She included a note explaining that she had attached extra pages and asked the examiners to check whether they had been accounted for.

When the recount results came back, her suspicion proved correct—the additional pages containing key parts of her answers had been overlooked. Her recalculated score not only restored her distinction but also placed her among the top students in her class.

Aroha shared the news with her whānau, who celebrated her perseverance. But she also took a moment to thank her professors for their work and acknowledge the importance of the process.

Moral of the Story

This story reflects the principles of whakamanawa (perseverance) and aro nui (attention to detail). Aroha’s success came not only from her hard work but from her willingness to trust her instincts, reflect thoughtfully, and act with respect for the academic system.

Her journey also highlights manaakitanga—the importance of showing gratitude and care for others, even when seeking justice for oneself. For Aroha, her achievement was not just a personal victory but a way to honour her tūpuna and demonstrate how Māori values can guide success in all aspects of life.

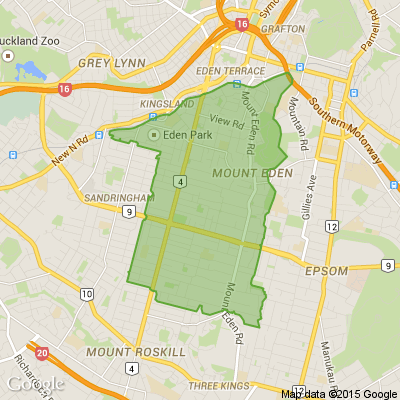

Dry cleaners mt Roskill

Hello our fellow neighbors I was hoping someone would know where the old dry cleaners we had up at the lights on dominion road have moved to?? I was out of town and when I came back they were gone .... I had some items that I would really love to get back but if only I new where they moved to or how to get In Touch with the owners to see what they did with our clothes if they closed down or moved elsewhere? Any updates or news about it would be amazing neighbors. Have a great day

Valentine’s Special | Custom Massage & Energy Healing

A 120-minute bespoke massage and energy-healing session designed to bring awareness and sensation back into the body. Ideal for a grounding, nervous-system reset, and embodied presence.

Valentine’s Special: $200 (120 minutes)

Session includes

- Intuitive, tailored full-body massage

- Integrated energy-healing work

- Premium organic massage oils

- Custom aromatherapy

- 432Hz healing frequency soundscape throughout

Why Valentine’s?

Valentine’s doesn’t have to be outward or performative. This session is a way to reconnect internally, release stored tension, and return to the body with clarity and ease.

About

Experienced professional masseuse and energy healer. Sessions are one-on-one only and adapted precisely to what the body presents on the day.

Available in Helensville, Auckland CBD, or as a mobile service.

Limited Valentine’s availability.

Message to book or enquire.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.2% For. Self-service is less frustrating and convenient.

-

43.7% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Loading…

Loading…