Savvy youngsters have many financial tools at their disposal

Back in the 1970s and ‘80s, you didn’t learn if your parents didn’t teach you or you weren’t tenacious.

Findings from the third stage of Massey University’s Financial Education and Research Centre show young New Zealanders are growing in their financial capability, although young men are doing better than young women.

The study found life experience has replaced parents as the primary source of financial information.

Whether you’re 13, 30, or any other age, Money Month is a great time to get started on personal financial skills, or to brush up on them. Just don’t fall for the ‘poor me’ mentality. You have to want to learn, and here are some tools.

Educational websites

==================

Many websites and YouTube channels offer free resources and courses on financial literacy. You don’t need to be at school to use the Sortedinschools.org.nz resources, which include a range of diverse topics from “what is cryptocurrency” to “building a tiny house”.

Another New Zealand-based resource is Banqer, which has opened up its Virtual Economy Experience to adults for Money Month. Get in fast. The offer is limited to 1000 adults.

You’ll also find numerous YouTube channels dedicated to personal finance. A good local channel is MoneyHub New Zealand. Most personal finance concepts transcend borders, and there are plenty of overseas ones as well, such as The Ramsey Show. International education resources such as Investopedia or the Khan Academy’s personal finance and financial literacy sections are very good.

Personal finance tools and apps

==========================

For some people, jumping in there and just doing it is the way to learn. Tools ranging from money personality profilers to simple-to-use budgets and much in between can help with learning how to manage money while actually doing it. Sorted.org.nz has web-based tools that enable you to write a budget and more. There are multiple mobile apps for tracking expenses, setting budgets and saving money. New Zealand-based apps such as PocketSmith are very good. Some overseas ones such as Spendee and Fudget work here. Spendee, like PocketSmith, can download your bank transactions automatically. MyBudgetPal from Booster also does that. It is New Zealand-based and free. But at the time of writing, Booster was working on fixing tech problems.

Books

=====

They’re old tech, but books are still popular with young people. Bookshops are seeing a revival in this demographic. My colleague Frances Cook’s books Tales From A Financial Mess and the more recent Your Money, Your Future are good places to start. Frances made mistakes young and had to teach herself about money. She understands what digging yourself out of a financial hole looks like. The Barefoot Investor by Australian Scott Pape has a huge following among younger people. Another international book focused very much on coming of age in personal finance is Why Didn’t They Teach Me This in School? by Cary Siegel. It teaches eight important money lessons. The other book I should mention is The Sharesies Guide to Investing by Brooke and Leighton Roberts and Sonya Williams. The only reason I hesitate is that it’s important to learn to “walk”, i.e. grasp basic financial tasks, before “running”, which I define as investing beyond KiwiSaver.

Financial simulations and games

===========================

Gamification is a great way to learn. Both Sortedinschools.org.nz and Banqer offer personal finance games. If you are interested in learning about investing, then trading games, simulators and demo accounts are helpful. They allow you to lose virtual money rather than the real stuff. Investopedia and MarketWatch offer virtual portfolios that follow the actual markets, so you can watch what would have happened if you had been investing your own money instead of virtual funds. If you must dive in, then you can tinker on sites such as Sharesies with a few dollars at a time. But please don’t assume you’re going to be better at this than the experts. Sooner or later, markets fall and new investors get burned.

Finally, young people learn by making mistakes. The tools above can help, but sometimes getting it wrong is the only thing that gets through. I know it’s hard, but try not to save them when they do something dumb like spending their rent on UberEats. Or if they’ve crashed the car, make sure they pay off every last cent of that $1000 insurance excess. No matter how long it takes them. Hopefully, they won’t do that again.

Stolen Haro red mountain bike

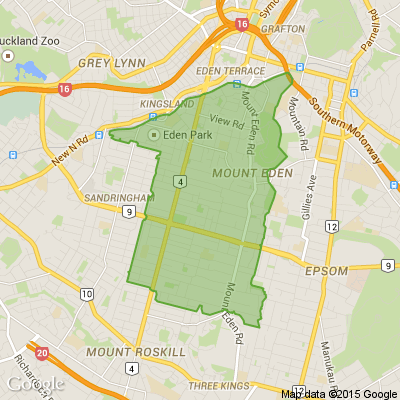

My son’s red Haro mountain bike was stolen near Cornwall Park Avenue.

It was parked at our residence on 22nd January at around 8:00pm. We discovered it missing on 25th January at around 2:00pm.

If anyone living near Cornwall Park Avenue has CCTV footage between those dates and times, could you please check and let me know if you notice anything suspicious or see a red Haro mountain bike (photo attached)?

We would really appreciate any help. Please message me if you have any information.

Thank you so much.

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

17 yr old looking for after school job please

Hi

I'm looking for any type of part time work for my son.

Hes a lovely guy with a good attitude towards hard work.

Anyone that could help id love to chat

0274547423

Loading…

Loading…