Poll: What are the living costs that are having the biggest (and perhaps surprising) impact on your wallet?

Butter, power bills, and those sneaky surcharges on your card ... it feels like everything’s creeping up in price lately. We’ve seen the headlines, but we want to hear it from you.

Overall, Most Kiwis say they’re ‘not prospering’. But, according to Retirement Commission data, some members of our community (women, Māori, and Pacific people) are experiencing worsening financial positions at elevated rates.

Stats NZ tells us that food prices have jumped 4.6% since this time last year, with meat and dairy doing most of the damage. This jump is hitting us all, but groceries are just one part of the picture.

When basic costs keep climbing, the old cost-saving tricks — like bulk-buying or stockpiling on sale — don’t always work. Who can afford to spend more upfront when every dollar already has a job?

We want to know: What costs have caught you off guard the most? What are the expenses that feel impossible to juggle right now?

Share your thoughts below!

-

43.5% Grocery bills

-

33% Utilities

-

1% Your treats (the ones that keep you human day to day, and are ESSENTIAL!)

-

0.1% Education

-

7.6% Healthcare

-

1.3% Travel (public transport/petrol)

-

7.9% Rent or mortgage

-

1.5% Social costs: birthday gifts and occasions

-

4.1% Other - share below!

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

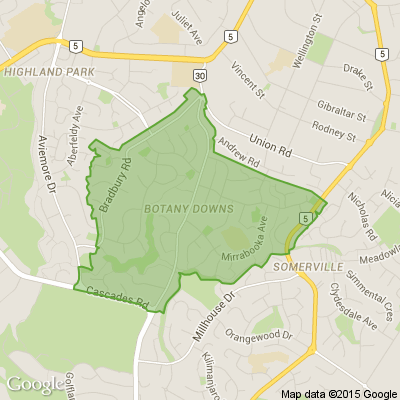

Here's what you need to know before making an offer on a house

🏠 What is the neighbourhood like?

Familiarise yourself with the neighbourhood, to check accessibility to public transport, schools and shops. Visit the street at different times of day, to find out how quiet or noisy it gets. Check with the local council whether they know of any future developments in the area that could increase noise or traffic.

🏠 How much are the rates and insurance?

Do a property search on the local council’s website to see what the rates are.

You can also get quotes from insurers to find out what it might cost to insure it.

Check whether the homeowner is paying off the cost of installing insulation or heating units through their rates, because you will inherit that debt if you buy the house.

🏠 For a unit title, check the pre-contract disclosure

If the property is on a unit title development (for example, an apartment), ask to see the pre-contract disclosure. This is basic information about the unit and the unit title development.

🏠 Get a LIM (Land Information Memorandum) report

A LIM report tells you everything the local council knows about the land and the buildings, for example, what building consents and code compliance certificates they have issued for work done on the property.

🏠 Pre-purchase building inspection

Get an independent building inspector to examine the house thoroughly and look for potential problems with weather-tightness, wiring, plumbing or the foundations (piles).

Ask them to check for features that might make maintenance more difficult. For example, some types of wall claddings need specialist knowledge to maintain, access to the gutters might not be straightforward, and retaining walls can be expensive to repair.

🏠 Check the property title

Ask a lawyer or conveyancer to check the property title for things like easements. For example, an easement might allow a neighbour to access part of the property. The property title should also confirm the property boundary.

More information is on the Settled website:

www.settled.govt.nz...

Image credit: Ray White New Zealand

Info credit: Citizens Advice Bureau: cab.org.nz

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.6% For. Self-service is less frustrating and convenient.

-

43.2% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Loading…

Loading…