Top Tip - Xero's Best Feature - A Best Kept Secret

It is a mystery to me why this feature is not used more often. I have yet to see a new client transfer across to Epiphany Accounting Solutions either as a bookkeeping client or an accounting client with this feature previously used.

GST Reconciliation - In your Xero you will find the tab GST Reconciliation. Here you can enter the amounts you have filed GST for sales and purchases with IRD. It shows you what has been paid, journals that have impacted GST, what GST is held in debtors and creditors and finally how much is owing in GST. You can then use this to reconcile with your GST balance sheet account.

The only reason I can think of as to why this feature is not used is that it has a flaw - in that it is not intuitive. Once you have entered your GST return information and saved, happy with your return. Next return time when you click on GST Reconciliation the information has disappeared. I can only imagine the number of people who give up on this feature at this point. But there is a trick!

Save your GST Reconciliation as published. When you are ready to do your next return go to Reports - Published. Click open your last return and at the bottom left hand side select copy and edit. Extend the date range to include your next return date and update.

Once you have completed your latest GST reconciliation, remember to SAVE as published. So easy. I hope this tip helps you manage your Xero Small Business GST with ease.

Of course if you need any assistance please reach out to me at info@epiphanyaccountingsolutions.co.nz and I am very happy to help you.

Free Breathwork Session - Wed 25th Feb

Feeling constantly activated? Running on stress as your baseline?

Join us for a free breathwork session Wednesday, 25th Feb.

Learn how to shift from reacting to responding. From chaos to clarity.

What you'll experience:

* Reduced stress and genuine calm

* Mental clarity and creative flow

* Better sleep and emotional processing

* Tools you can use anytime, anywhere

No experience needed. No special equipment. Just you and your breath.

Details:

📅 Wednesday, 25th Feb

⏰ 7 - 8 pm

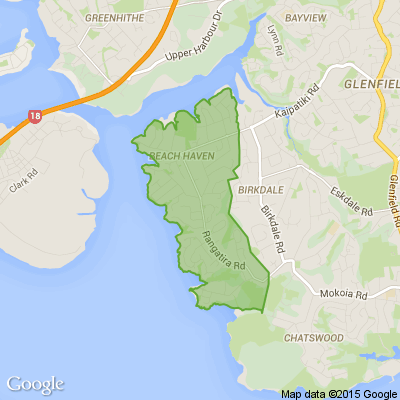

📍 Birkenhead

💰 Completely free

Led by Kelly & Jason, certified breathwork instructors from our community.

Spaces are limited. Text 027 555 5907 to reserve your spot (limit 20 spaces).

Varicose Veins Slowing You Down?

New Zealands first dedicated Varicose Vein Clinic Specialising in Non-Surgical, walk in, walk out treatments No GP Referral Needed!

Don’t let painful, swollen, or unsightly veins affect your daily life. Whether you're dealing with throbbing aches, night cramps, swelling, or visible varicose veins, our expert team is here to help.

At The Vein Centre, we specialise exclusively in vein treatments, no distractions, no GP referral required, just fast, effective care tailored to you. Regain comfort and confidence in your legs with the latest minimally invasive treatments.

212 Wairau Road, Glenfield

09 444 5858

info@theveincentre.co.nz

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.6% Yes, supporting people is important!

-

25.9% No, individuals should take responsibility

-

14.5% ... It is complicated

Loading…

Loading…