Personalised stickers

Message for details. Suitable for many surfaces such as cars, lunch boxes, plant pots, boards for parties.

Can do iron on as well.

Peeps bunnies for Easter are $10

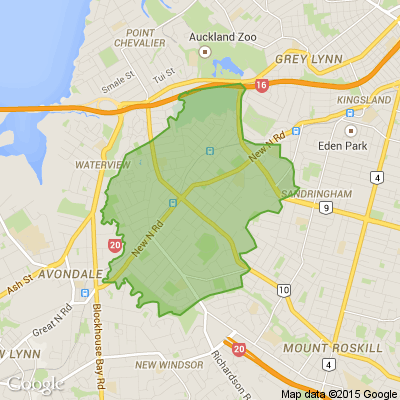

Dry cleaners mt Roskill

Hello our fellow neighbors I was hoping someone would know where the old dry cleaners we had up at the lights on dominion road have moved to?? I was out of town and when I came back they were gone .... I had some items that I would really love to get back but if only I new where they moved to or how to get In Touch with the owners to see what they did with our clothes if they closed down or moved elsewhere? Any updates or news about it would be amazing neighbors. Have a great day

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.4% For. Self-service is less frustrating and convenient.

-

43.5% I want to be able to choose.

-

47.1% Against. I want to deal with people.

New BEGINNERS LINEDANCING CLASS

Epsom Methodist church

12 pah Rd GREENWOODS cnr. Epsom

Monday 9th February 7pm - 9pm

Tuesday 10th February 10am -11am

Just turn up on the day

Loading…

Loading…