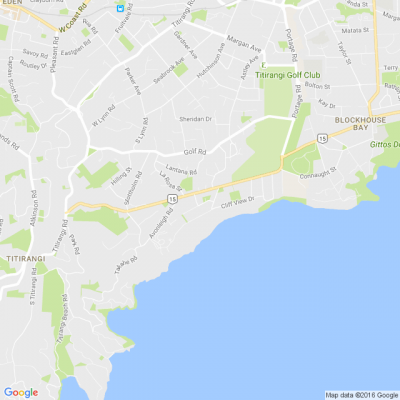

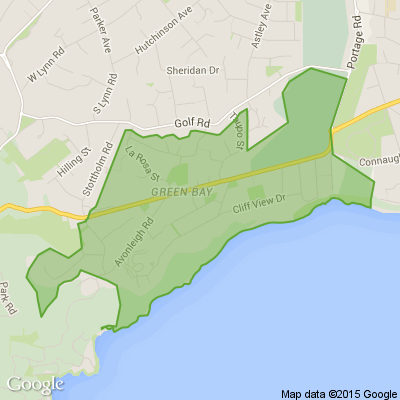

The 2018 Census found nearly 40,000 homes were empty in Auckland, compared with 6000 more than five years ago.

Property investors who have left their houses empty could soon be asked by the Auckland Council to consider housing rough sleepers or people struggling to find an affordable rental. Auckland mayor Phil Goff says he has spoken to the Government and NGOs (non-governmental organisations) about how the thousands of "ghost houses" or vacant properties across the city could be used to help ease a housing shortage. Just over 7 per cent of Auckland's properties were vacant - which is high by international standards but includes properties where residents were out for the night. Goff has previously said he does not support a tax on vacant land or properties. But he is considering a different approach. "I have had discussions with Government and with Housing First around how houses left vacant longer term might be utilised for housing purposes with the agreement of their owners," he told. "This is currently a work in progress, and I hope in due course an initiative might be able to be announced around how we could incentivise owners of such properties to provide those houses for rental purposes." It was not known what the incentives could be. Under the Housing First programme, private landlords who lease their properties to homeless people get guaranteed rent through a housing supplier, which also covers any maintenance costs and arranges social services and support for the tenant. Auckland mayoral candidate John Tamihere told he would act on housing rough sleepers in empty houses if it was proven feasible.

"I would move on it because we're not going to build our way out of the problem in the short to medium term," he said. Tamihere raised concerns over how accurate the 2018 Census was in terms of there being 40,000 homes empty in Auckland. However, if he was elected mayor he would "absolutely" be prepared to investigate further into ghost houses and possible solutions for homelessness. Auckland Council estimates that there is a shortfall of 46,000 homes in the city and some have argued there should be penalties for people who deliberately leave homes empty rather than renting them out. A tax on vacant land and property is being considered as part of the Government's tax reforms. The Productivity Commission has been instructed to include it in its review of local government funding. However, Finance Minister Grant Robertson has been warned that such a tax is expensive to set up and is difficult to enforce. In Vancouver, owners of vacant homes are taxed 1 per cent of the house's value a year, as long as it is not their family home. The tax has been credited with a 15 per cent drop in the number of vacant properties. One of the obstacles to considering a similar tax in New Zealand is the absence of accurate data on how many properties are vacant for long periods. The Census 2018 figure of 40,000 homes includes properties of residents who were away on Census night, holiday homes, and homes which were being renovated. It is not known what portion of them are "ghost houses". Vector and the Ministry of Business, Innovation and Employment attempted to get more accurate data in 2015 by checking which houses were using minimal electricity for long periods. They found around 8000 homes - or 1.6 per cent of all dwellings - were unoccupied, meaning they had used less than 400W of power a day for 100 days or more. Most of them were in northern beach suburbs and Waiheke Island, which led the researchers to conclude they were holiday homes and baches.

A Watercare spokeswoman said it was not possible to do a similar study because its meters were not set up to measure zero water use. Any research would be complicated by blocks of flats with shared water meters or single properties with multiple meters, she said.

==========================================================

Even Australians get it - so why not Kiwis???

“Ten years ago, if a heatwave as intense as last week’s record-breaker had hit the east coast, Australia’s power supply may well have buckled. But this time, the system largely operated as we needed, despite some outages.

On Australia’s main grid last quarter, renewables and energy storage contributed more than 50% of supplied electricity for the first time, while wholesale power prices were more than 40% lower than a year earlier.

[…] shifting demand from gas and coal for power and petrol for cars is likely to deliver significantly lower energy bills for households.

Last quarter, wind generation was up almost 30%, grid solar 15% and grid-scale batteries almost tripled their output. Gas generation fell 27% to its lowest level for a quarter century, while coal fell 4.6% to its lowest quarterly level ever.

Gas has long been the most expensive way to produce power. Gas peaking plants tend to fire up only when supply struggles to meet demand and power prices soar. Less demand for gas has flowed through to lower wholesale prices.”

Full article: www.theguardian.com...

If even Australians see the benefit of solar - then why is NZ actively boycotting solar uptake? The increased line rental for electricity was done to make solar less competitive and prevent cost per kWh to rise even more than it did - and electricity costs are expected to rise even more. Especially as National favours gas - which is the most expensive form of generating electricity. Which in turn will accelerate Climate Change, as if New Zealand didn’t have enough problems with droughts, floods, slips, etc. already.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.4% Yes, supporting people is important!

-

26.1% No, individuals should take responsibility

-

14.5% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Loading…

Loading…