Largest NZ insurance broker, PIC, is exploiting the dire situation

You may wish to know of this exploitation by a firm which is supposed to be respected.

Largest NZ insurance broker, P.I.C, is exploiting and dealing underhandedly with their clients in the dire situation that New Zealanders are in by charging an APR of nearly 25% to pay monthly. This is outrageous and disgusting at a time when we all need to pull together.

My partner’s 25 year old business lost 100% of its income when the lockdown started. Most suppliers helped to try and keep her afloat either by reducing their charges by up to 66% or deferring payment so that she would be in a position to restart when the lockdown ended.

PIC, NZ largest insurance broker, was approached to allow a monthly payment of the insurance premium payable on 15 April 2020. They agreed and quoted an interest rate of 9% - high but not extortionate at this time. No mention was made of the fact that a finance company would be involved. Finance papers were then emailed for a company called Stockade Premium Funding Ltd showing an APR of 24.83% and a flat rate of 9.8%. There is no risk to Stockade Premium Funding Ltd as a Direct Debit has to be signed and if payment stops the insurance is immediately cancelled.

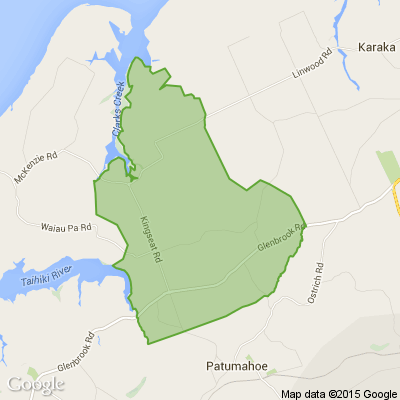

When PIC office in Pukekohe was queried about the interest rate they stated that they had no knowledge of the 25% and that the interest rate was only 9%. When asked to review the position, they stated that the terms to go monthly were non-negotiable.

P.I.C INSURANCE BROKERS LIMITED (Company #451964) and the finance company, STOCKADE PREMIUM FUNDING LIMITED (Company #1138701), are majority owned and totally controlled by Michael Geoffrey GARNER, 20 Chisbury Terrace, Shelly Park, Manukau, 2014 , New Zealand

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.5% Yes, supporting people is important!

-

24.6% No, individuals should take responsibility

-

15.9% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Night-time chipsealing works on SH2

From 9 to 17 February, stop/go traffic management will be in place on SH2 between McPherson Road and Dimmock Road on multiple nights between 9pm and 5am (Sundays to Thursdays).

During the day, all lanes will be open, but speed restrictions will apply to allow the chipseal to set and to protect vehicles travelling over the newly laid surface.

There may be delays to your journey when travelling through the area. This is weather dependent so check NZTA Journey Planner before you travel.

Loading…

Loading…