Market Insights

Number of first home buyers getting into a home of their own at an eight year low

The number of first home buyers getting into a home of their own at the start of this year was at its lowest level since 2015.

According to the latest Reserve Bank figures, banks approved just 1166 mortgages for first home buyers in January, the lowest number in any month of the year since January 2015 (apart from April 2020 when housing market activity came to a standstill due to the Covid lockdown).

And as mortgage interest rates have been steadily rising, the amount being borrowed by first home buyers has been steadily decreasing.

In January this year the average value of the loans approved to first home buyers was $548,885. That's down by $46,513 (-7.8%) from its May 2022 peak of $595,398.

However almost a third of those loans approved in January this year were low equity loans to first first home buyers with less than a 20% deposit.

In January this year, 370 low equity mortgages were approved to first home buyers.

Although that is a low number, it made up 31.7% of all the mortgage approved to first home buyers in January.

That was the first time the low equity loans to first home buyers have gone above 30% of the total since November 2021, when house prices also hit their cyclical peak.

While rising interest rates have reduced the number of first home buyers getting into their own homes, they are also affecting the amount they are paying for them.

Although higher interest costs mean fewer aspiring first home buyers are getting into a home of their own, they are proving to be a more resilient part of the market than either investors or existing owner-occupiers.

However the low overall number of mortgages being approved to aspiring first home buyers suggests that home ownership likely remains an impossible dream for many.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

58.4% Yes, supporting people is important!

-

25.8% No, individuals should take responsibility

-

15.8% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Recycling question!

Kia ora neighbours,

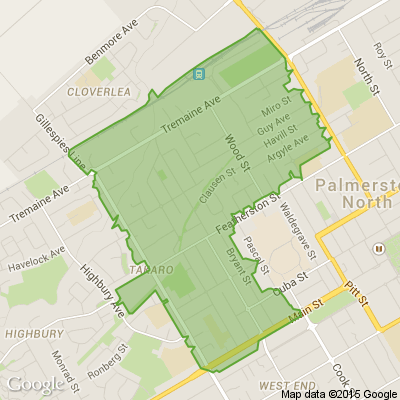

Is there anywhere yet in Palmy where bubble wrap & polystyrene can be taken for recycling?

Thank you.

Loading…

Loading…