Land Transport (Revenue) Amendment Bill

You have 4 days left to make a submission on the above bill (link below). This bill should it become law will make it compulsory for you to have an Electronic GPS Road User Charge device in your vehicle.

This will allow a 3rd party operator to monitor and store all data relating to your travel, including travel route, how often, when, distance and speed. While the Government says this is only for monitoring distance, there is nothing stopping them or future governments to use it to track people and send out speed infringements for even traveling 1km over the limit at ANY point during you journey.

This 3rd party company is also there to make a profit, as such any savings at the pump by the removal of the fuel tax will simply be added back on in excess with service fees when you buy your mileage in advance. There is also an up to $15,000 fine for using a non authorized device that could be interpreted a device for for measuring distance, like a dash cam or GPS system etc. This could mean you have to buy an expensive authorised device to use for monitoring.

Given the recent wave of breeches of data from Neighbourly and Manage My Health, the Government cannot guaranty that this data will be safe from hack; or even simply sold in aggregate form to data brokers and insurance companies wanting to increase premiums based on how you drive, where you drive and how fast. My suggestion was that the MUST make a Non invasive Hubometer or similar off line device available for those of use who do not wish to install an Orwellian State Surveillance device in our cars

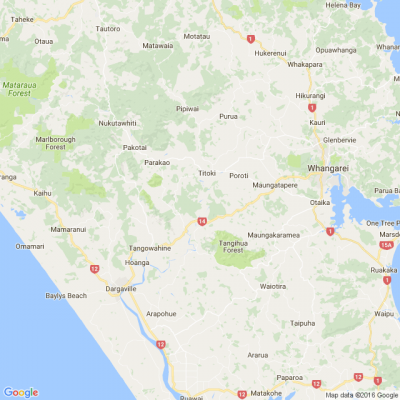

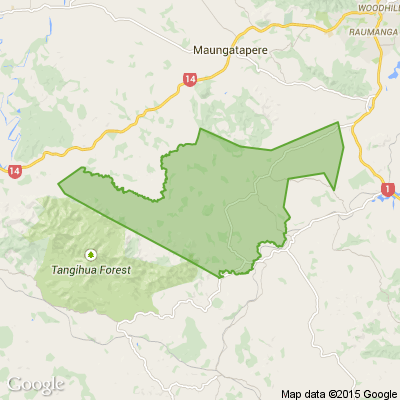

This bill is also attempting to add tolls to the new Warkworth to Wellsford and Bynderwyn roads when constructed, while at the same time forcing heavy transport to use these toll roads instead of the free routes. Also hidden in this bill is the ability to toll the CURRENT roads, State Highway 1 between Auckland and Whangarei, you know the ones we've been paying for for decades with the fuel tax.

The Government is trying to slip this past during the Christmas break, to avoid the public backlash or submissions. Submissions END Wednesday 7th at 11.59pm. Make your voice heard.

bills.parliament.nz...

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.8% Yes, supporting people is important!

-

25.9% No, individuals should take responsibility

-

14.4% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Loading…

Loading…