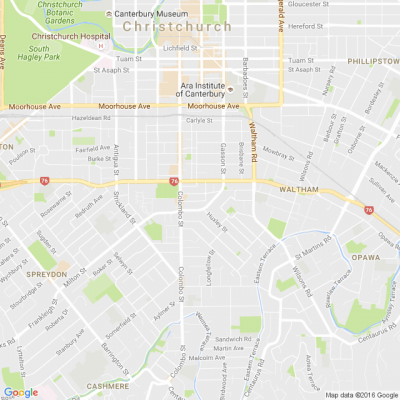

Christchurch City Council rules out rates discount for inner-city new home buyers

A rates discount for new home buyers in central Christchurch is off the table after being rejected as an incentive to lift inner-city population.

The Christchurch City Council has also ditched the idea of providing a shared-equity scheme for the central city over concerns it will be duplicated by similar programmes run by the Government.

The decisions come after a new long-awaited report into the supply and demand of central city homes found the council has little influence over construction and land costs, which have the biggest impact on the cost of housing. The report was due in July last year.

The council wants 20,000 people living within the four avenues by 2028. The latest estimates from Stats NZ has the population at 7170, up 8.3 per cent on the previous year.

About 230 homes have already been completed in the central city this year, another 41 are being built and 127 are consented but work has yet to start. By the end of the year, more homes will have been built in 2020 than in any other year for the past decade.

But the council still faces an uphill battle to reach its population target, with another 4500 homes needed over the next eight years.

The report found inner-city residential developers are hampered by land supply and quality issues, uncertain demand, strong competition from the suburbs and finance conditions.

“Buyers are value conscious and the central city does not currently offer value compared to the same-priced alternatives,” the report said.

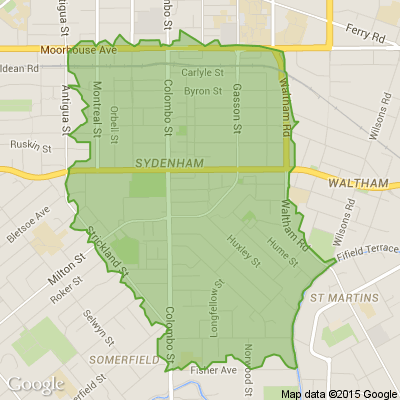

Potential buyers believed they could get better value for money in the fringe suburbs close to the four avenues.

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

60.3% Yes, supporting people is important!

-

24.3% No, individuals should take responsibility

-

15.4% ... It is complicated

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.7% For. Self-service is less frustrating and convenient.

-

43.1% I want to be able to choose.

-

47.2% Against. I want to deal with people.

Loading…

Loading…