All self-employed people, including contractors and sole traders, can claim expenses against their income.

What you can claim for

Business expenses can include:

==========================

vehicle expenses, transport costs and travel for business purposes

rent paid on business premises

depreciation on items like computers and office furniture

interest on borrowing money for the business

some insurance premiums

work-related journals and magazines

membership of professional associations

home office expenses

work-related mobile phones and phone bills

stationery

work uniforms

tax agent’s fees.

===============

If you own an investment property, expenses you can claim for include:

=========================================================

repairs and maintenance (but not renovations that substantially improve the value of the property)

professional services fees, like accountants, lawyers or property managers

rates and insurance

mortgage repayment insurance

vehicle and travel expenses when you travel to inspect your property or do repairs

depreciation on capital expenses, like whiteware, appliances or heat pumps

legal fees involved in buying a rental property, as long as the expense is $10,000 or less.

How much can you claim?

=====================

You can't claim the whole cost of all items, even those only for business use. Some things you can only claim half for, eg some entertainment expenses. You can only claim 100% of the cost for an expense that’s entirely for business use.

If you have an expense that’s partly for your business and partly for your private use, you can claim the proportion that relates to your business.

Example:

If you spend half the time driving a vehicle to deliver goods and the other half for your own reasons, you can claim 50% of the travel costs for your business.

For some expenses, like business entertainment, eg client meals and staff functions, you can only claim half.

Working from home

================

If you use an area of your home for your business, eg your study or garage, you can claim a portion of the household expenses, eg:

rates

power

house and contents insurance

mortgage interest if you own the home

rent if you are renting the home.

You must keep invoices for these expenses.

How it works

===========

If your home is 100 square metres and your working space is 10 square metres — 10% of the total area — you can claim 10% of expenses that are not solely for your business, eg your home phone line.

If you aren't using a separate area of your home for business, you'll need to take into account how much time you spend on your business and the area used.

If you're GST registered, the GST content on home office expenses can be claimed as they’re paid — in each GST return period — or at the end of your tax year. Mortgage interest and rent don’t include GST.

====================================================

New BEGINNERS LINEDANCING CLASS

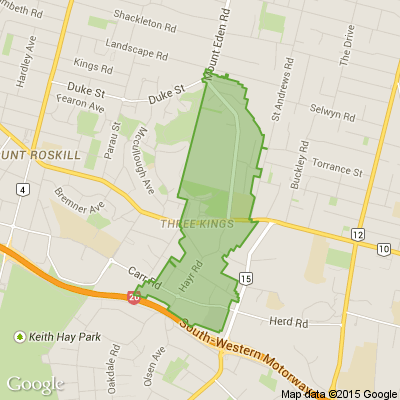

Epsom Methodist church

12 pah Rd GREENWOODS cnr. Epsom

Monday 9th February 7pm - 9pm

Tuesday 10th February 10am -11am

Just turn up on the day

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.5% For. Self-service is less frustrating and convenient.

-

43.4% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Loading…

Loading…