Dairy and meat lovers are the biggest losers as food prices rise again

Food prices have steadily increased in March, with the monthly change driven by higher prices for grocery food and non-alcoholic beverages.

According to the latest Stats NZ Selected Price Index, monthly food prices increased by 0.5% in March compared with a 0.5% monthly decrease in February.

But on an annual basis, food prices were 3.5% higher than in March 2024.

Grocery food and non-alcoholic beverages had the biggest monthly impact on food price in March 2025, up 0.9% and 1.1%, respectively.

Higher prices for chocolate and yoghurt drove the increase in grocery food prices, while higher prices for instant coffee and soft drinks drove the increase in non-alcoholic beverage prices.

On an annual basis, butter prices are more expensive by 63.6% compared to March 2024, cheese is up by 20.4%, and milk is more expensive by 16%.

Stats NZ prices and deflators spokeswoman Nicola Growden said “The average price for a 250g block of chocolate was $5.99 in March 2025, that’s $1.60 more expensive than three years ago”.

Monthly fruit and vegetable prices fell by 0.3% compared with February, and were down 2.7% compared to March 2024, still the only food group to record lower prices compared to 2024.

Tomatoes and cabbage had the largest monthly price shifts, with their weighted average retail price up by 15.2% and 12.1% respectively.

Meat, poultry and fish prices were virtually flat for the month, growing by 0.1%, but on an annual basis they remain high, up by 5.3% compared to March 2024.

Likewise, restaurant meals and ready-to-eat food remained steady, also increasing by 0.1% for the month.

Alcohol monthly prices grew slightly in March, up by 0.2%, while monthly tobacco prices fell by 0.1%.

Monthly petrol prices fell in March, dropping by 2.1%, and are now 6.2% cheaper than in March 2024.

Monthly diesel prices were down by 2.3%. Annually, diesel prices were down by 10.6%.

Domestic air travel prices rose in March by 2.2%, while international air transport prices fell by 4% compared to February.

Domestic accommodation service prices fell 2.9% in March but international accommodation services increased by 8.8%.

After a few months of delay, Stats NZ has also been able to reveal the changes in rental prices.

The stock measure grew by 0.3% monthly, now 3.3% more expensive compared to last year.

The stock measure shows rental price changes across the whole rental population, including renters currently in tenancies.

The flow measure of rents captures rental price changes only for dwellings that have a new tenancy started in the reference month.

===================================================

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.5% For. Self-service is less frustrating and convenient.

-

43.5% I want to be able to choose.

-

47.1% Against. I want to deal with people.

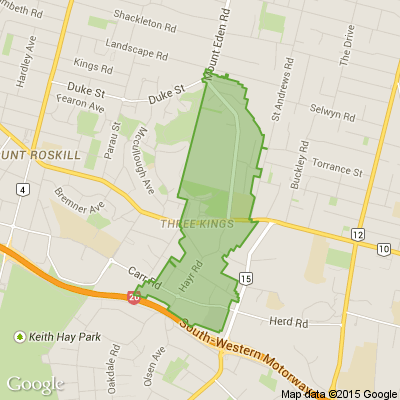

New BEGINNERS LINEDANCING CLASS

Epsom Methodist church

12 pah Rd GREENWOODS cnr. Epsom

Monday 9th February 7pm - 9pm

Tuesday 10th February 10am -11am

Just turn up on the day

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…