Changes to benefit rates from 1 April 2025

Main benefits will increase by over 3 percent, instead of 1.66 percent, on 1 April with the Government’s decision to annually adjust benefit rates to increases in the average wage.

If you're paid weekly

=================

In the week of 31 March your payment will be at the old rate. This is because we pay you for the week that's just been.

In the week of 7 April you'll get part of your payment at the old rate, and part at the new.

In the week of 14 April your whole payment will be at the new, increased rate.

If you're paid fortnightly

===================

1 April is partway through your pay period, so on 8 April you'll get a partial increase.

You'll get the full increase on 19 April – this is paid early (instead of 22 April) due to Easter.

More people can get support

=======================

Income and asset limits and cut-out points for some financial supports will also go up. This means more people could get things like:

Accommodation Supplement

Disability Allowance

Childcare Assistance

Community Services Card, and

help with urgent and unexpected costs.

About the increase

================

The Annual General Adjustment happens every year on 1 April. On this day benefits and most other financial supports from us are adjusted to account for the cost of living (inflation). Some income thresholds are adjusted by the average wage growth.

The new rates are based on either the:

==============================

Consumers Price Index (2.22% rise), or

net average wage (3.51% rise).

Main benefits are adjusted to the Consumers Price Index.

==============================

For April 2025 NZ Super and Veteran's Pension rates receive an extra boost, making their total increase around 3 percent because of the relationship to the net average wage level.

==============================

Impact on your other payments

When your main benefit increases, you may find this changes other payments you get from us, like Accommodation Supplement or Temporary Additional Support.

If you have housing contributions for emergency, transitional, or social housing, your contributions may change as well.

The total amount you get after the 1 April changes won't be less than what you're getting now.

Changes to other payments if your main benefit goes up

How to check your payments

========================

From Tuesday 1 April you can check your new payments by either:

logging in to MyMSD, or

calling our Service Express self-service line on 0800 33 30 30

===================================================

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.5% For. Self-service is less frustrating and convenient.

-

43.5% I want to be able to choose.

-

47.1% Against. I want to deal with people.

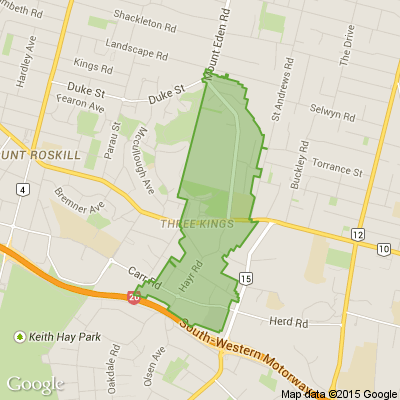

New BEGINNERS LINEDANCING CLASS

Epsom Methodist church

12 pah Rd GREENWOODS cnr. Epsom

Monday 9th February 7pm - 9pm

Tuesday 10th February 10am -11am

Just turn up on the day

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…