Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Redcross from Sandringham

Fiction 3 for $5

Non-Fiction 2 for $5

571 Sandringham Road

Monday-Friday: 10am to 5pm

Saturday: 10am to 4pm

Hi neighbours,

Please take part in our Customer Feedback Survey if you regularly use Auckland’s state highway network.

Your feedback will help us understand what's working well and which areas need improving. Together we can create better and safer journeys for everyone.

Click … View moreHi neighbours,

Please take part in our Customer Feedback Survey if you regularly use Auckland’s state highway network.

Your feedback will help us understand what's working well and which areas need improving. Together we can create better and safer journeys for everyone.

Click the link below to participate.

The team at NZ Transport Agency Waka Kotahi

Find out more

Mike from Mount Eden

55x55x85cm

A bit overenthusiastic, tends to freeze up after a couple of days running.

Pick up central Mt Eden,

Price: $25

Diba from Hillsborough

Hi Neighbors! I provide reliable and loving care for your furry friends. Please get in touch to learn more about my services 🐾 :)

Soniyaa Siingh from The Expert Maths Tuition Center LTD Blockhouse Bay

Elevate your math skills this holiday season with our exclusive tutoring offers. Secure your spot now.

#SouthAuckland #epsom #aucklandschools #blockhousebay #nz #Glendene #mathstuition

Soniyaa Siingh from The Expert Maths Tuition Center LTD Blockhouse Bay

Hear from our students about how personalised and effective teaching methods at our center have transformed their understanding and performance in mathematics.

www.facebook.com...

#SouthAuckland #epsom #aucklandschools #blockhousebay #nz #Glendene #mathstuition

For only $15 a ticket, you could be in to win this brand-new, fully furnished Jennian home located in gorgeous Mangawhai, worth almost $1.4 million dollars.

Featuring three bedrooms, two bathrooms and an open-plan kitchen, living and dining area, this home is waiting to be loved by its new … View moreFor only $15 a ticket, you could be in to win this brand-new, fully furnished Jennian home located in gorgeous Mangawhai, worth almost $1.4 million dollars.

Featuring three bedrooms, two bathrooms and an open-plan kitchen, living and dining area, this home is waiting to be loved by its new owner.

Make this coastal property your permanent residence, a holiday home, a rental, or you can simply sell it!

Get your tickets today at heartlottery.org.nz.

Find out more

Eve from Onehunga

Have you tried Yin Yoga before? 🌸

Yin Yoga:

*Slow-paced yoga style where poses are held for longer durations, typically 3 to 5 minutes or more.

*Targets connective tissues, such as ligaments, tendons, and fascia, rather than muscles.

*Emphasizes relaxation and surrendering into each pose, … View moreHave you tried Yin Yoga before? 🌸

Yin Yoga:

*Slow-paced yoga style where poses are held for longer durations, typically 3 to 5 minutes or more.

*Targets connective tissues, such as ligaments, tendons, and fascia, rather than muscles.

*Emphasizes relaxation and surrendering into each pose, often practiced with mindfulness and deep breathing.

Benefits of Practicing Yin Yoga:

*Improved Flexibility: Holding poses for longer periods allows for deep stretching, enhancing flexibility over time.

*Stress Relief: Yin yoga's emphasis on relaxation and mindfulness can help reduce stress and promote mental clarity.

*Joint Health: Gentle, sustained stretches target the joints, promoting mobility and potentially reducing the risk of injury and joint stiffness.

www.facebook.com...

All levels welcome.

Thursdays 6.30-7.30PM

Sundays 4.30-5.30PM

Onehunga Community House, 83 Selwyn Street,

Room 8 (rear of the house) Bolsters, mats and blocks provided. $15/class

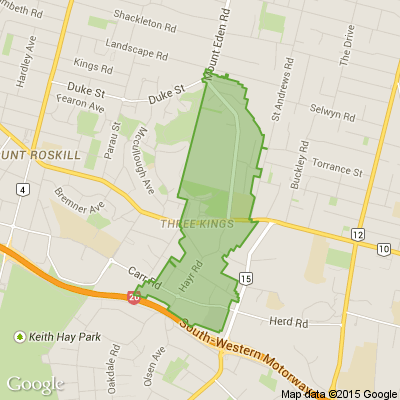

The Team from Resene ColorShop Mt Roskill

Magnetic frames make it easy to change what’s on display – whether it’s wallpaper or works of art. Paint yours in Resene testpots to contrast what's on display and complement your home's décor.

Find out how to create your own with these easy step by step instructions.

Durba from Mount Eden

Two consecutive Tuesday evenings covering the essential steps and key secrets.

When: Tuesday July 23, 30: 6:00pm – 8:00pm

These evenings are for those sincerely interested in establishing an

effective personal meditation practice deepening their spiritual lives.

With course teacher … View moreTwo consecutive Tuesday evenings covering the essential steps and key secrets.

When: Tuesday July 23, 30: 6:00pm – 8:00pm

These evenings are for those sincerely interested in establishing an

effective personal meditation practice deepening their spiritual lives.

With course teacher Jogyata Dallas, author and a longtime student of the late Indian master Sri Chinmoy. These evenings will cover a wide canvas of meditation methods and introduce the fundamentals in getting started with your home practice. For those wishing to progress further, there will be ongoing free evenings in July-August as well.

Venue: Sri Chinmoy Centre, 89 Dominion Rd, Mt Eden.

Entry is through the side door just around the corner in Tawari Street.

Registration: Free admission, but registration is required to accommodate numbers.

Please use the contact form below, or text your name, number attending to: Jogyata 0221887432.

Feel free to call this number for all other course inquiries.

The Team from Auckland Council

We want your feedback on the number of elected members Tāmaki Makaurau has, how they are elected, and where electoral boundaries lie. Click "read more" to tell us what you think

Danielle from Lynfield

Sony Bravia 26 Inch TV

Good working order

Please note remote not supplied* Have used previously with a Google Chromecast (not for sale). Please PM if interested only.

Must Pick up.

Price: $60

The Team from Neighbourly.co.nz

...You can see right through them.

No, we haven't lost the plot! July 1st is International Joke Day and because laughter is good for your body, we want to get involved.

So, go on, jokers! Share your best joke below...

82 replies (Members only)

Shell from New Windsor

You supply the shirt. I can supply baby onesies.

These can be personalised for you

Message me for details

Negotiable

Soniyaa Siingh from The Expert Maths Tuition Center LTD Blockhouse Bay

Through EMT's math tuition, I've gained the skills and confidence to excel in mathematics, unlocking my potential to succeed academically and beyond.

www.facebook.com...

#SouthAuckland #epsom #blockhousebay #nz #Glendene #mathstuition

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2026