You should be concerned about the IRD giving social media companies our data

The IRD is giving your data to Facebook – taxpayers' data to Facebook, that was the headline yesterday.

We give them our data in trust and confidence. Well, we don't actually, we give them our data because the law says we must file our tax returns and tell them who we are and how much we're earning.

But perhaps you assume that the law says that they must keep it to themselves. Not so.

I think this is a scandal.

To be honest when I read the headline, I thought IRD must have been hit by one of those phone scams. You know, they've been cold called by Nigerian prince and handed over our private data.

But no, the RNZ report says they give Facebook and the big tech guys some of our information because it's anonymised. They're calling it hashed. So they can't see who you are when they hand it over.

And it's only for the purposes of IRD placing ads on these platforms like Facebook, et cetera, so don't worry about it.

Sorry, I am worried, and I reckon most Kiwis will hate this.

The reason is pretty simple: it's trust.

Do you trust Facebook? No.

Do you believe they will keep your data secure? No.

Do you believe they won't marry up your private data that our government has just handed them on a silver platter with the profiles they have on you already? No.

No one trusts these guys.

I don't want some government department sending my data to some Silicon Valley server so that some tech guy can bug me with intrusive ads about what undies to buy.

I actually think there's more to this story, and there will be because they have a life of their own. It won't just be the IRD that's doing it. There will be other government departments, there'll be other private data, there'll be more of us affected.

Luxon should get ahead of this and just say let's have some kind of little review because otherwise you're going to get these headlines ticking over and over and over, and I think people will be sick of it.

Also, as citizens, we need to have faith that when we give our data to the government that it is kept secure and safe, and even a perception that it's not is not good enough.

===================================================

www.newstalkzb.co.nz...

====================================================

Poll: 🤖 What skills do you think give a CV the ultimate edge in a robot-filled workplace?

The Reserve Bank has shared some pretty blunt advice: there’s no such thing as a “safe” job anymore 🛟😑

Robots are stepping into repetitive roles in factories, plants and warehouses. AI is taking care of the admin tasks that once filled many mid-level office jobs.

We want to know: As the world evolves, what skills do you think give a CV the ultimate edge in a robot-filled workplace?

Want to read more? The Press has you covered!

-

52.9% Human-centred experience and communication

-

15% Critical thinking

-

29.6% Resilience and adaptability

-

2.5% Other - I will share below!

Room for rent

🌿 Beautiful Private Space Available for Rent – Perfect for 2 Girls or a Couple 🌿

Located in the peaceful and family-friendly suburb of Lynfield, this warm and welcoming home offers a comfortable living space in a highly sought-after top school zone.

✨ What’s Included:

🏡 2 Spacious Bedrooms

🛁 Private Bathroom

🍳 Separate Kitchen

🛏️ 1 Bed with Mattress

🔥 Stove

📟 Microwave

Unlimited WiFi included

✔ Power & water included

✔ Bus stop in front of the house

✔ Nearby shops and supermarkets

This setup is ideal for two girls or a couple looking for a quiet, safe, and relaxed place to call home.

🌸 Enjoy living in a serene neighbourhood with a friendly community atmosphere, while still being conveniently close to schools, shops, and transport.

If you're looking for comfort, privacy, and a peaceful lifestyle — this could be your perfect new home 💛

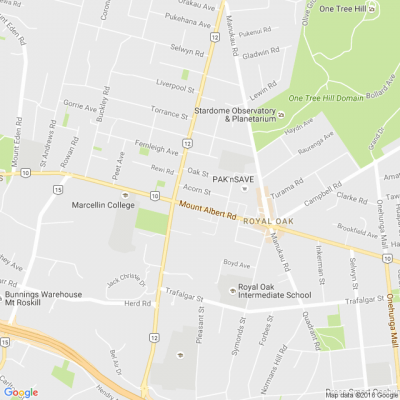

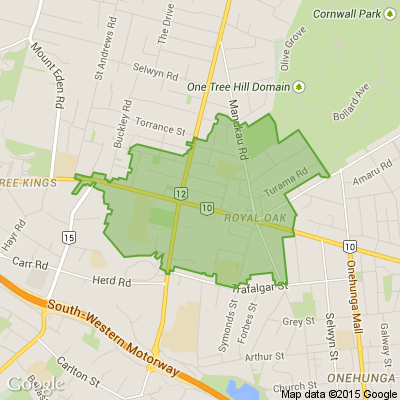

📍 Location: Lynfield, Auckland

📩 Message for more details or to arrange a viewing. For couple $450 for one bedroom. $600 for the 2 bedroom and kitchen and bathroom. Feel free to contact me on 022-422-0145 for any other details

Brain Teaser of the Day 🧠✨ Can You Solve It? 🤔💬

Make a hearty dish. Take just half a minute. Add four parts of kestrel. Then just add one. What have you made?

(Trev from Silverdale kindly provided this head-scratcher ... thanks, Trev!)

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…