JULY--1st----Today's changes that could affect your bank account

The start of July brings a raft of changes that will affect households across the country.

From prescription changes to mortgage tweaks, the rules, fees and taxes will affect the way that many people spend and borrow money.

Here are a few of them.

===================

Debt-to-income ratios and loan-to-value restriction tweaks

==============================================

New debt-to-income rules will limit how much banks can lend to borrowers, compared to their household income.

Only 20 percent of lending can go to owner-occupier buyers with a debt-to-income ratio of six, and only 20 percent of investors loans will be able to be at a debt-to-income ratio of more than seven.

The debt-to-income calculation takes into account other debt, such as student loans.

These rules are not expected to make a big difference initially, because not much lending is currently being done above those levels. However, they are likely to limit the extent of future house price growth.

At the same time, loan-to-value rules will be eased slightly to allow banks to give 20 percent of lending to owner-occupier borrowers with a deposit or equity of less than 20 percent, and 5 percent of lending to investors with a deposit or equity of less than 30 per cent.

Previously, they could only lend 15 percent to owner-occupiers with less than 20 percent deposit and 5 percent of lending to investors with less than 35 percent.

Prescription charges

=================

A $5 charge is coming back on for prescriptions.

This does not apply to people who are over 65, Community Services Card holders, people who are under 14 or people ages 14 to 17 who are dependent on a Community Services Cardholder.

Auckland regional fuel tax abolished

==============================

The Auckland Regional Fuel Tax scheme ended on 30 June.

This is worth 11.5c per litre on petrol, diesel and their biovariants.

FamilyBoost introduced

===================

The FamilyBoost policy takes effect from 1 July, offering a payment of 25 percent of early childhood education fees for households up to $75 a week.

This is available in full to households earning up to $140,000 and reduces for those earning up to $170,000.

Households should start saving their invoices from 1 July as either PDF or JPG files, Inland Revenue says.

Payments will be made in three-monthly blocks, starting in October.

Bright-line test reduced

===================

From 1 July, the bright-line test will reduce to two years, from the current 10 years, or five for new builds.

The bright-line test sets a limit on how long properties, apart from someone's main home, have to be held to avoid tax on capital gains when they are sold.

That means that properties sold on or after Monday now need to have been held for at least two years to avoid the automatic tax.

Chartered Accountants Australia and New Zealand is warning there could be some confusion, though, because the new rules focus on the "disposal" date of a property rather than the acquisition date.

"Care needs to be taken as the dates are determined differently. The bright-line end date is determined by when the seller first enters a contract for sale, whereas the start, or acquisition date is typically determined when title transfers."

He said that could mean that anyone who had entered negotiations before 1 July could still be captured under the old rule.

Paid parental leave increases

========================

Each year, the maximum amount of paid parental leave available increases.

How much you get is determined by how much you were earning before you went on leave.

From 1 July, the maximum is $754.87 a week before tax, compared to $712.17 previously.

Gaming duty for offshore operators

=============================

From 1 July, a 12 percent offshore gambling duty applies operators who are taking bets from New Zealand residents.

Offshore gambling operators have to register for GST if they make more than $60,000 in a 120-month period. Those that are registered for GST must also now register for the duty.

Excise tax on alcohol increases

The annual adjustment of excise tax on alcohol takes place on 1 July. This is based on movements in the consumer price index in the year to March.

=================================================

www.newshub.co.nz....

==================================================

Chapter Book and Tea Shop Jan-Feb 2026 Book Catalogue

📚 JAN-FEB 2026 BOOK CATALOGUE 📚

Welcome back and best wishes for 2026! The new year sees the arrival of lots of goodies including Ilona Andrews’ BEAST BUSINESS (Hidden Legacy Series—Novella), Mary Balogh’s REMEMBER THAT DAY (Ravenswood Series), Christine Feehan’s DARK JOY (Dark Carpathian Series), Jayne Ann Krentz’s THE SHOP ON HIDDEN LANE (Set in Fogg Lake), Lauren Palphreyman’s THE NIGHT PRINCE (Wolf King Series), Leigh Rivers’ INSATIABLE (Edge of Darkness Series), J.D. Robb’s STOLEN IN DEATH (In Death Series), Nalini Singh’s SUCH A PERFECT FAMILY and more. Enjoy your reading!

NB. We have temporarily sold out of Mary Balogh’s “REMEMBER THAT DAY” and we expect it to be back in stock in around two weeks’ time.

Check out the catalogue at

chapter.co.nz...

Please see p.2 for the:

• Order link for signed copies of Nalini Singh’s SUCH A PERFECT FAMILY

• Pre-order link for signed copies of Nalini Singh’s ARCHANGEL’S ETERNITY

• Details of the Romance Writers of New Zealand Short Story Contest sponsored by Chapter (in April 2026).

• Details of the Auckland Romance Readers Book Club Monthly Meetings and Auckland Romance Readers Book Club Facebook Group.

For Orders, Enquiries or to check instore dates:

✉️ info@chapter.co.nz ☎️ 09-6232319 📱 021-635027

NB. Chapter’s trading hours are Tue–Sun 10–4. We are CLOSED on Mondays.

#ChapterBookandTeaShop #Tea #TeaShop #Books #Bookshop #RomanceBookshop #RomanceFictionSpecialist #BiMonthlyBookCatalogue

Poll: 🤖 What skills do you think give a CV the ultimate edge in a robot-filled workplace?

The Reserve Bank has shared some pretty blunt advice: there’s no such thing as a “safe” job anymore 🛟😑

Robots are stepping into repetitive roles in factories, plants and warehouses. AI is taking care of the admin tasks that once filled many mid-level office jobs.

We want to know: As the world evolves, what skills do you think give a CV the ultimate edge in a robot-filled workplace?

Want to read more? The Press has you covered!

-

52.8% Human-centred experience and communication

-

14.7% Critical thinking

-

29.6% Resilience and adaptability

-

2.9% Other - I will share below!

Room for rent

🌿 Beautiful Private Space Available for Rent – Perfect for 2 Girls or a Couple 🌿

Located in the peaceful and family-friendly suburb of Lynfield, this warm and welcoming home offers a comfortable living space in a highly sought-after top school zone.

✨ What’s Included:

🏡 2 Spacious Bedrooms

🛁 Private Bathroom

🍳 Separate Kitchen

🛏️ 1 Bed with Mattress

🔥 Stove

📟 Microwave

Unlimited WiFi included

✔ Power & water included

✔ Bus stop in front of the house

✔ Nearby shops and supermarkets

This setup is ideal for two girls or a couple looking for a quiet, safe, and relaxed place to call home.

🌸 Enjoy living in a serene neighbourhood with a friendly community atmosphere, while still being conveniently close to schools, shops, and transport.

If you're looking for comfort, privacy, and a peaceful lifestyle — this could be your perfect new home 💛

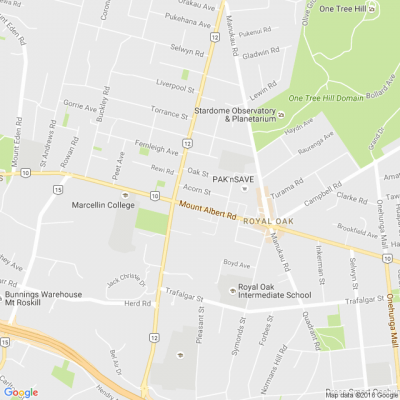

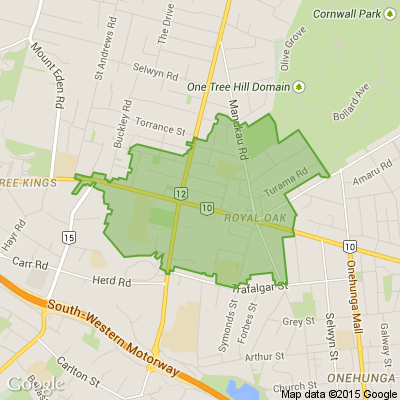

📍 Location: Lynfield, Auckland

📩 Message for more details or to arrange a viewing. For couple $450 for one bedroom. $600 for the 2 bedroom and kitchen and bathroom. Feel free to contact me on 022-422-0145 for any other details

Loading…

Loading…