7000 pensioners overcharged in another Inland Revenue error

Almost 7000 pensioners have been affected by another Inland Revenue error.

Last week, RNZ reported that 4500 people had overpaid tax after their imputation credits had been incorrectly recorded in their prep-populated tax returns.

Others got in touch and said they had also experienced a problem, this time with the way that NZ Super was recorded for ACC purposes.

One man said he had been charged $301.68 in ACC earner levy for $18,854.98 of gross income from NZ Super that should not have attracted a levy at all.

He said he was not able to control this when he completed his return and did not realise the error until the process was complete.

He said he did not think a lot more about it but when he saw RNZ's reporting of the other error, he realised that there had been at least two this year.

"This really starts to suggest a deficiency in change control of IRD systems."

Another couple said they wanted assurance that Inland Revenue had taken steps to stop it happening again.

======================================

Inland Revenue said 6778 people were affected.

======================================

"There was an issue identified earlier this year where we were not populating the 'earnings not liable' figure correctly for some customers. We fixed those returns for the customers in July 2025."

Chartered Accountants Australia New Zealand tax leader John Cuthbertson said ACC was not paid on NZ Super because it was not liable income.

"However, if you're working and receiving NZ Super, your earnings from that work do attract levies."

"The advancements in digitalisation and MyIR have been quite incredible, except when it goes wrong like this. You shouldn't need a Chartered Accountant to check prepopulated forms, but the average person might not know that super income does not attract ACC levies. We used to say 'google it' but many taxpayers are now using AI to do a basic check of their tax returns, asking simple questions like 'Should I pay 'x' levy on 'y' income?"

Angus Ogilvie, managing director of Generate Accounting Group, said it was concerning that issues seemed to be leading to erroneous data being prepopulated into Inland Revenue's system.

"The new software employed was a very costly and complex project. However, taxpayers should expect that there is a high level of diligence applied to get their tax obligations right. Let's hope that the department is devoting urgent resource to correct these issues".

======================================================

Poll: 🤖 What skills do you think give a CV the ultimate edge in a robot-filled workplace?

The Reserve Bank has shared some pretty blunt advice: there’s no such thing as a “safe” job anymore 🛟😑

Robots are stepping into repetitive roles in factories, plants and warehouses. AI is taking care of the admin tasks that once filled many mid-level office jobs.

We want to know: As the world evolves, what skills do you think give a CV the ultimate edge in a robot-filled workplace?

Want to read more? The Press has you covered!

-

52.5% Human-centred experience and communication

-

14.6% Critical thinking

-

29.8% Resilience and adaptability

-

3% Other - I will share below!

High Tea at Alberton 2026

High Tea at Alberton 2026

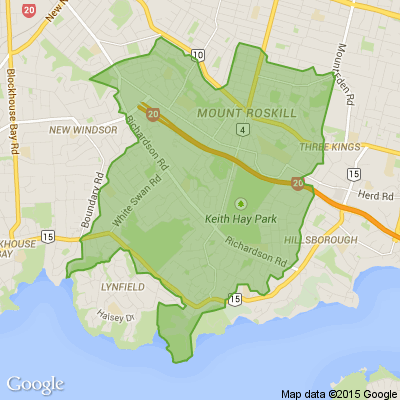

The popular high tea service at Alberton in Mt Albert is being held this year on Sunday 22&29 March at 2 pm. Join us to enjoy a traditional tea service served in the atmospheric ballroom or out on the lovely verandah at this much-loved heritage site.

The price includes entry to the house prior to, or after the service. Bookings are essential as numbers are limited. Book on Eventbrite:https: //Albertonhightea2026.eventbrite.co.nz

Chapter Book and Tea Shop Jan-Feb 2026 Book Catalogue

📚 JAN-FEB 2026 BOOK CATALOGUE 📚

Welcome back and best wishes for 2026! The new year sees the arrival of lots of goodies including Ilona Andrews’ BEAST BUSINESS (Hidden Legacy Series—Novella), Mary Balogh’s REMEMBER THAT DAY (Ravenswood Series), Christine Feehan’s DARK JOY (Dark Carpathian Series), Jayne Ann Krentz’s THE SHOP ON HIDDEN LANE (Set in Fogg Lake), Lauren Palphreyman’s THE NIGHT PRINCE (Wolf King Series), Leigh Rivers’ INSATIABLE (Edge of Darkness Series), J.D. Robb’s STOLEN IN DEATH (In Death Series), Nalini Singh’s SUCH A PERFECT FAMILY and more. Enjoy your reading!

NB. We have temporarily sold out of Mary Balogh’s “REMEMBER THAT DAY” and we expect it to be back in stock in around two weeks’ time.

Check out the catalogue at

chapter.co.nz...

Please see p.2 for the:

• Order link for signed copies of Nalini Singh’s SUCH A PERFECT FAMILY

• Pre-order link for signed copies of Nalini Singh’s ARCHANGEL’S ETERNITY

• Details of the Romance Writers of New Zealand Short Story Contest sponsored by Chapter (in April 2026).

• Details of the Auckland Romance Readers Book Club Monthly Meetings and Auckland Romance Readers Book Club Facebook Group.

For Orders, Enquiries or to check instore dates:

✉️ info@chapter.co.nz ☎️ 09-6232319 📱 021-635027

NB. Chapter’s trading hours are Tue–Sun 10–4. We are CLOSED on Mondays.

#ChapterBookandTeaShop #Tea #TeaShop #Books #Bookshop #RomanceBookshop #RomanceFictionSpecialist #BiMonthlyBookCatalogue

Loading…

Loading…