Inland Revenue taking tougher line on student loan debtors

Inland Revenue is taking a tougher stance on overseas-based student loan defaulters, including border arrests.

More than 70% of 113,733 overseas borrowers are in default, owing $2.3 billion.

Since July, Inland Revenue collected $207 million, a 43% increase, from overseas borrowers.

======================================================

The arrest of a person arriving at the border last month over unpaid student loan debt is an example of Inland Revenue “making up for lost time”, one tax expert says.

Inland Revenue said at the end of April there were 113,733 people with student loans believed to be based overseas. More than 70% were in default on their loans, owing $2.3 billion, of which more than $1b is penalties and interest.

For about 24,000 of these overseas-based borrowers, the debt is more than 15 years old.

Inland Revenue has been taking a tougher line, including arrests at the border as a “measure of last resort”.

“New Zealand Customs informs us of any border crossings into New Zealand by overseas-based borrowers and airlines provide the travel information to us. We apply to the district court and the police make the actual arrest,” spokeswoman Jane Elley said.

“Once arrested and taken before the courts, a judge can order the defaulter to make reasonable efforts to arrange repayment to Inland Revenue.”

Since July 1 last year, 89 people had been told they could be arrested at the border. Eleven had taken action by either making acceptable payments, entering repayment plans or applying for hardship provisions.

“One person was arrested at the border last month and they have since paid off their debt.

“There are just over 150 overseas-based borrowers, with a combined default of $15m, who we actively look out for in case they return to New Zealand.”

Elley said Inland Revenue had collected more than $207m in repayments since July last year from student loan borrowers living overseas – a 43% increase on the same period the previous year.

Inland Revenue had an increase in student loan compliance funding in last year’s Budget.

“We’ve contacted more than 12,000 borrowers, 1320 have entered repayment plans, and 960 people have fully repaid their overdue amounts. They have collectively repaid $9m,” Elley said.

She said the department was also looking at borrowers who owned property in New Zealand. There were just over 300, she said.

“During the first six months of our increased compliance work they paid up $1.7m. For defaulters within this group who have refused to engage and resolve their default, further legal enforcement action will be taken, which may include NZ-based bankruptcy or charging orders over their properties.

“There were also 151 [borrowers] with NZ-based investments, and between July and December last year we received payments totalling $84,000 from some of them. Again, there could be legal action ahead, including taking deductions from their investments or bank accounts receiving interest income.”

Robyn Walker, a tax partner at Deloitte, said it was another example of where Inland Revenue had been dormant for a while and was now making up for lost time.

“In the past there has seemingly been very little effort applied to contacting overseas-based student loan defaulters, and ... many of them ... probably were blissfully unaware of mounting repayment liabilities, penalties and interest if Inland Revenue had difficulty contacting them.

“We’ve periodically heard the stories of borrowers being arrested at the border, and it’s actions like that which can really spur people on to get on top of their obligations.

“No one wants to not be able to come back to New Zealand for a special event or family emergency because they’re concerned that their student loan will catch up with them.”

Poll: 🤖 What skills do you think give a CV the ultimate edge in a robot-filled workplace?

The Reserve Bank has shared some pretty blunt advice: there’s no such thing as a “safe” job anymore 🛟😑

Robots are stepping into repetitive roles in factories, plants and warehouses. AI is taking care of the admin tasks that once filled many mid-level office jobs.

We want to know: As the world evolves, what skills do you think give a CV the ultimate edge in a robot-filled workplace?

Want to read more? The Press has you covered!

-

52.4% Human-centred experience and communication

-

15% Critical thinking

-

29.7% Resilience and adaptability

-

2.8% Other - I will share below!

Share your favourite main crop potato recipe and win a copy of our mag!

Love potatoes? We will give away free copies of the May 2026 issue to readers whose potato recipes are used in our magazine. To be in the running, make sure you email your family's favourite way to enjoy potatoes: mailbox@nzgardener.co.nz, by March 1, 2026.

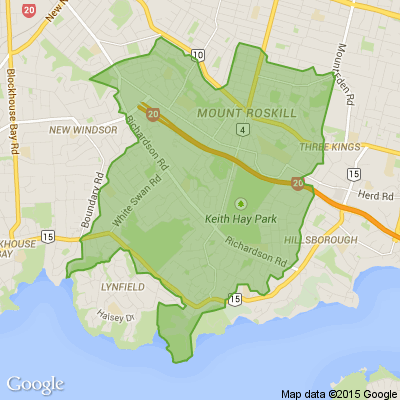

Auckland Seniors & Travel Expo

Neighbourhood locals are invited to the Auckland Seniors & Travel Expo, a relaxed and welcoming event bringing lifestyle, leisure, and travel together under one roof. Meet 50+ exhibitors showcasing travel ideas, retirement living, mobility solutions, health services, finance, and local clubs. Enjoy live music from Kulios, café seating, door prizes, and be in to win a Luxury Beachfront Escape for Two to Rarotonga.

Loading…

Loading…