7000 pensioners overcharged in another Inland Revenue error

Almost 7000 pensioners have been affected by another Inland Revenue error.

Last week, RNZ reported that 4500 people had overpaid tax after their imputation credits had been incorrectly recorded in their prep-populated tax returns.

Others got in touch and said they had also experienced a problem, this time with the way that NZ Super was recorded for ACC purposes.

One man said he had been charged $301.68 in ACC earner levy for $18,854.98 of gross income from NZ Super that should not have attracted a levy at all.

He said he was not able to control this when he completed his return and did not realise the error until the process was complete.

He said he did not think a lot more about it but when he saw RNZ's reporting of the other error, he realised that there had been at least two this year.

"This really starts to suggest a deficiency in change control of IRD systems."

Another couple said they wanted assurance that Inland Revenue had taken steps to stop it happening again.

======================================

Inland Revenue said 6778 people were affected.

======================================

"There was an issue identified earlier this year where we were not populating the 'earnings not liable' figure correctly for some customers. We fixed those returns for the customers in July 2025."

Chartered Accountants Australia New Zealand tax leader John Cuthbertson said ACC was not paid on NZ Super because it was not liable income.

"However, if you're working and receiving NZ Super, your earnings from that work do attract levies."

"The advancements in digitalisation and MyIR have been quite incredible, except when it goes wrong like this. You shouldn't need a Chartered Accountant to check prepopulated forms, but the average person might not know that super income does not attract ACC levies. We used to say 'google it' but many taxpayers are now using AI to do a basic check of their tax returns, asking simple questions like 'Should I pay 'x' levy on 'y' income?"

Angus Ogilvie, managing director of Generate Accounting Group, said it was concerning that issues seemed to be leading to erroneous data being prepopulated into Inland Revenue's system.

"The new software employed was a very costly and complex project. However, taxpayers should expect that there is a high level of diligence applied to get their tax obligations right. Let's hope that the department is devoting urgent resource to correct these issues".

======================================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.6% For. Self-service is less frustrating and convenient.

-

43.2% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Freehold, renovated, future potential

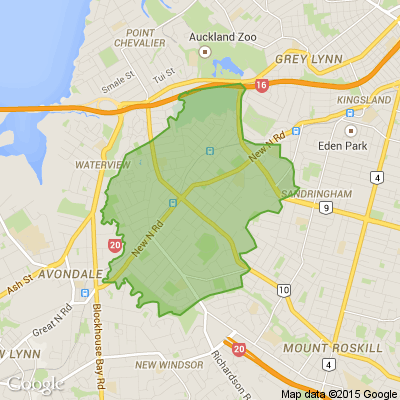

Hi everyone, we thought we’d share this here in case you, or someone you know, is looking for a lovely 2-bedroom freehold home in Blockhouse Bay. This has been our investment property for many years, and we’ve recently put a lot of care into preparing it for its next owners, including a brand-new kitchen, new flooring, and fresh paint inside and out. Set on a freehold section of around 560m², it offers a generous lawn, a new veggie garden, and future potential to add a cabin or sleepout. We truly hope it becomes a place where new memories are made.

For viewings, please contact Piyush and Manali Setia at Ray White Blockhouse Bay - 021 2363 854:

rwblockhousebay.co.nz...

Loading…

Loading…