Don't waste your money on extended warranties

About seven out of 10 shoppers are being offered an extended warranty at Apple Stores, Harvey Norman and Noel Leeming.

While extended warranties promise to pay for repairs for a specified period after the manufacturer’s warranty has expired, you’re likely paying hundreds of dollars for protection you already have under consumer law.

Our latest retailer survey found that three big retailers – Harvey Norman, Noel Leeming and Apple Stores – were the most likely to offer an extended warranty.

Only 2 to 3% of shoppers at the three big retailers were told by store staff what protection they already have under consumer law.

The more expensive the item, the more people were offered a warranty. This is especially so for large appliances (54%) and home tech (50%) purchases across all retailers surveyed.

Extended warranties may also be marketed as product care or damage protection plans.

We were happy to see only 3% of people who were offered an extended warranty went ahead with buying one. Although, we suspect this is because we surveyed our members and supporters, and they’re likely to be more clued up on their rights.

You’re already covered

===================

Under the Consumer Guarantees Act (CGA), manufacturers and retailers are obliged to guarantee the products they sell are of an acceptable quality and fit for their purpose. Most appliances, certainly the big-ticket ones, can be expected to perform well for many years, not just the period covered by the manufacturer’s warranty.

This means that if your product develops a fault when it’s still reasonably new, you can have it repaired or, if that isn’t possible, replaced – even if the manufacturer’s warranty has expired.

If the fault is substantial, you can choose between a refund, repair or replacement.

Therefore, there’s no value in having an extended warranty if the only thing it gives you is cover beyond the period of the manufacturer’s warranty.

The extended warranty may cover accidental damage, but so does your home and contents policy – for example, your contents insurance should cover damage to computers and electronic appliances from power surges.

When is an extended warranty a good idea?

===================================

An extended warranty is worth considering if it goes beyond the protections provided by the CGA. An example would be if a warranty guarantees replacement with a new item if something goes wrong, rather than having to wait for repairs.

When selling you an extended warranty, the retailer should tell you the extra rights it gives you on top of the CGA.

And remember, the CGA doesn’t apply to goods normally used for business purposes. So, if you’re buying items for business use, extended warranties may give you protection you don’t automatically have by law.

=====================================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.6% For. Self-service is less frustrating and convenient.

-

43.2% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Freehold, renovated, future potential

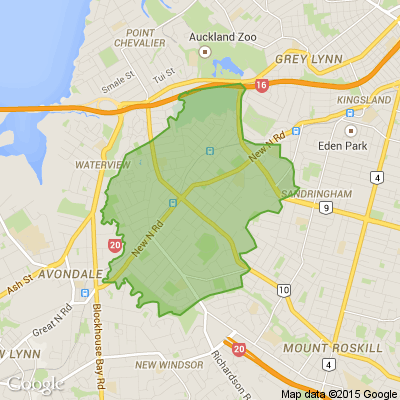

Hi everyone, we thought we’d share this here in case you, or someone you know, is looking for a lovely 2-bedroom freehold home in Blockhouse Bay. This has been our investment property for many years, and we’ve recently put a lot of care into preparing it for its next owners, including a brand-new kitchen, new flooring, and fresh paint inside and out. Set on a freehold section of around 560m², it offers a generous lawn, a new veggie garden, and future potential to add a cabin or sleepout. We truly hope it becomes a place where new memories are made.

For viewings, please contact Piyush and Manali Setia at Ray White Blockhouse Bay - 021 2363 854:

rwblockhousebay.co.nz...

Loading…

Loading…