New Zealanders losing more money to online credit card scams

Losses reported to Netsafe in October totalled $6264, compared to $1865 in September - a 220 percent jump.

In September, losses per incident averaged about $50, whereas the average loss last month was about $220.

However, the number of reports to Netsafe fell from 37 in September to 28 in October.

Netsafe chief online safety officer Sean Lyons said the sharp rise in financial losses suggested scammers were getting more sophisticated with their tactics.

"The quality of what people are being presented with is, on the whole, increasingly improving.

"Red flags we might've relied on previously - the spelling is wrong, it doesn't look right or I'm pretty sure that's not what the logo of this particular agency looks like - are becoming less valuable as a method for us to check whether something is a scam."

Credit card-related scams typically involve scammers collecting payment card numbers, and using them to make purchases or other payments online.

Lyons said people were being targeted via email, text, private instant messaging platforms - including WhatsApp - website and social media ads, and phone calls.

He said looking up an organisation's contact details and getting in touch with them directly was the best way to confirm whether a message was genuine.

"It might say that you have a payment due or a package waiting to be delivered.

"Don't be pressured into making a decision on the scammer's timeline. Step back, get advice from the people around you or give Netsafe a call.

"Make sure what you're engaging with is actually genuine and you're not being sucked into a scam."

With the festive season and Black Friday approaching, he said people should be extra vigilant, if asked to pay for something or if they saw an offer that seemed too good to be true.

"It's a time when people let their guard down a bit. When we are looking for deals or ordering and expecting the arrival of things, we can be more susceptible to these scams."

========================================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.6% For. Self-service is less frustrating and convenient.

-

43.2% I want to be able to choose.

-

47.2% Against. I want to deal with people.

Freehold, renovated, future potential

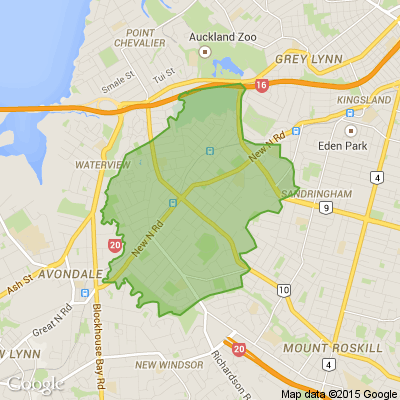

Hi everyone, we thought we’d share this here in case you, or someone you know, is looking for a lovely 2-bedroom freehold home in Blockhouse Bay. This has been our investment property for many years, and we’ve recently put a lot of care into preparing it for its next owners, including a brand-new kitchen, new flooring, and fresh paint inside and out. Set on a freehold section of around 560m², it offers a generous lawn, a new veggie garden, and future potential to add a cabin or sleepout. We truly hope it becomes a place where new memories are made.

For viewings, please contact Piyush and Manali Setia at Ray White Blockhouse Bay - 021 2363 854:

rwblockhousebay.co.nz...

Loading…

Loading…