Why Inland Revenue is taking money from bank accounts

Thousands of people have had money deducted from their bank accounts in recent months as Inland Revenue steps up its efforts to collect the tax it is owed.

IR spokesperson Rowan McArthur said it had sent out 16,500 notices about planned bank deductions since mid-June, 25 percent more than for the whole of last year.

"We are targeting customers who have repeatedly not engaged with IR; and those where information we have indicates there may be funds in their bank account(s) that could be deducted from to pay off existing tax debt."

He said IR was also working to get instalment payment plans in place.

What's going to happen to home loan rates? Listen to No Stupid Questions with Susan Edmunds

"As with all tax debt, we welcome customers contacting us so we can work with them to resolve their debt situation."

Between mid-June and September 30, there had been 8181 deductions completed, which had recovered $17 million. There were another 6026 deductions in progress, which had collected $5.5m.

John Cuthbertson, Chartered Accountants Australia New Zealand tax leader, said tax debt had ballooned in recent years and the "softly, softly" approach taken over the Covid years meant many people were given significant leeway with their tax bills.

"Tax debt as of March was $9.3 billion. When you think about it that's a significant amount of money. If you look at Budget 2024 and 2025, funding was allocated specifically for IRD to be more aggressive in terms of audit activity… debt is the focus and they certainly don't want to let it get any larger."

He said some of the debt was quite old and some IRD was trying to collect quickly before it became non-collectible.

IRD also had the power to apply to have money taken from people's wages if they were employed, he said.

"It's in people's best interest to get on top of their debt as early as they can and communicate. But we've had situations where employers or companies have used Inland Revenue as a bank by not paying some of these core taxes like GST and their PAYE - that's held on trust for the Crown. That means they've been living beyond their means, really."

Some accountants told RNZ it seemed people were only given a week's notice before money was taken, and it was tough for some businesses that were struggling.

Deloitte tax partner Robyn Walker pointed to Inland Revenue guidance that said people would typically have received advice about the amount that was past due and a warning letter.

That noted that, since its system upgrade, Inland Revenue had more information from a wider variety of sources, which allowed it to be more proactive.

"Inland Revenue also did a systems upgrade [recently] so that the MyIR system more prominently shows any tax debt when people log in. I've heard some feedback that some people think it feels aggressive," she said.

=====================================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.5% For. Self-service is less frustrating and convenient.

-

43.4% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Freehold, renovated, future potential

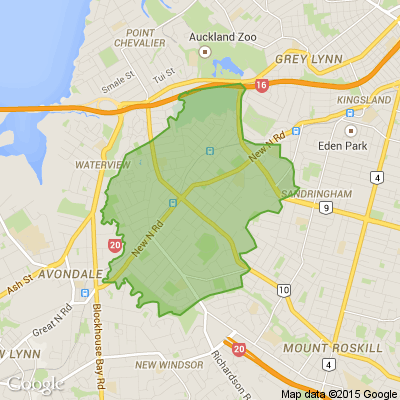

Hi everyone, we thought we’d share this here in case you, or someone you know, is looking for a lovely 2-bedroom freehold home in Blockhouse Bay. This has been our investment property for many years, and we’ve recently put a lot of care into preparing it for its next owners, including a brand-new kitchen, new flooring, and fresh paint inside and out. Set on a freehold section of around 560m², it offers a generous lawn, a new veggie garden, and future potential to add a cabin or sleepout. We truly hope it becomes a place where new memories are made.

For viewings, please contact Piyush and Manali Setia at Ray White Blockhouse Bay - 021 2363 854:

rwblockhousebay.co.nz...

Loading…

Loading…