Auckland tenants ordered to pay $27k for dog‑damaged rental home

A property manager was forced to cut her final inspection of an Auckland rental property short after being greeted by hundreds of flies, a strong stench of dog poo and urine-soaked carpet.

The Barfoot and Thompson property manager said she could barely enter the property due to the smell of dog urine and faeces.

She was so concerned about the state of the house, she shortened the report to one overall category, noting there were a number of areas that were intentionally damaged by the tenants, Barry Phillips and Tessa Boyd, and their two dogs and six puppies.

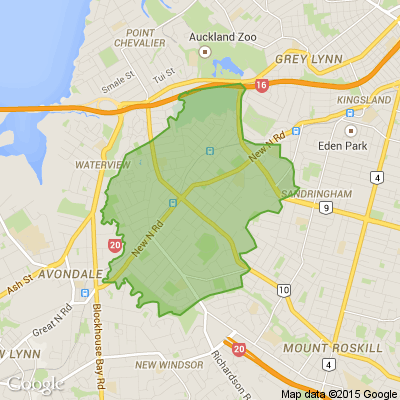

“The dogs have defecated and urinated all over the floors, and the stench was very strong,’' Keely Stubbs, the head of property management for the agency’s Mt Eden branch, said in her final inspection report of the Massey house.

“There were hundreds of flies. The floor at the entrance to the first bedroom has been damaged. It appears to be wet from urine.”

Wet items were left on the downstairs floor, the front door wasn’t secure, and the keys hadn’t been returned.

Now the Tenancy Tribunal has awarded the landlords – Barfoot and Thompson as agents for Rysy Investments – $27,000, saying the pair must have known the damage that was being done during their four-year tenancy.

“The tenants allowed a situation where they had six puppies inside, toileting all over the flooring and carpet for a series of months,” tribunal adjudicator Melissa Allan said in a recently released decision.

“The tenants must have known the damage was a certainty.”

Scratch marks, holes in couches, piles of rubbish

=======================================

According to the decision, the house wasn’t always in such a poor state. Photos presented at the hearing, taken in May 2023, show the house in a fairly tidy condition, except for two damaged doors, a large pile of rubbish in the laundry, and unkempt lawns.

During that inspection, it was also discovered that the tenants had two dogs (only one of which was permitted) and puppies, which were all housed inside.

The tenants, who were supposed to move out in September 2023, successfully sought a three-month extension, giving them time to re-home the puppies, repair the two doors and maintain the lawns.

But after the tenants left, photos showed the carpet in the bedrooms and hallway was covered in urine and faeces, as was the laminate flooring in the lounge and the terracotta tiles downstairs.

There were scratch marks all over the walls, and some of the carpet had been scratched and torn. A couch in one room had been upended, with the stuffing torn out and covering most of the floor. A window was broken, and there were holes in the walls.

The tenants also left behind a fridge full of food, multiple couches, a double bed and mattress, various drawers, a table, and chairs, a TV cabinet, and huge piles of what appeared to be soiled bedding.

Rubbish was left under the house and strewn throughout the garden.

Barfoot and Thompson asked the Tenancy Tribunal for rent arrears and compensation.

While the decision noted the landlord had claimed insurance for some of the damage, it didn’t cover all of it, including the cost of repairing the flooring, because the insurers believed it was gradual damage.

Soft and swollen particle board

=========================

The landlord said the flooring was so badly damaged that all the carpet, timber underlay, and the vinyl in the kitchen had to be removed.

The floors in the hallway and bedroom also had to be cut out and replaced as the urine had softened and swollen the particle board. Photos showed it was heavily stained and damaged.

Taking into account depreciation and betterment, the tribunal awarded the landlord $23,118 for repairs to the flooring.

A further $5000 was awarded for removing rubbish both inside and under the house, bringing the total award to $27,391.

=======================================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.6% For. Self-service is less frustrating and convenient.

-

43.2% I want to be able to choose.

-

47.2% Against. I want to deal with people.

Freehold, renovated, future potential

Hi everyone, we thought we’d share this here in case you, or someone you know, is looking for a lovely 2-bedroom freehold home in Blockhouse Bay. This has been our investment property for many years, and we’ve recently put a lot of care into preparing it for its next owners, including a brand-new kitchen, new flooring, and fresh paint inside and out. Set on a freehold section of around 560m², it offers a generous lawn, a new veggie garden, and future potential to add a cabin or sleepout. We truly hope it becomes a place where new memories are made.

For viewings, please contact Piyush and Manali Setia at Ray White Blockhouse Bay - 021 2363 854:

rwblockhousebay.co.nz...

Loading…

Loading…