Budget 2023 highlights: What's in it for YOU?

The key highlights:

===============

Extension of 20 hours Early Childhood Education to include 2-year-olds - $1.2b

Abolition of $5 prescription co-payment - $619m

Cheaper public transport for children - $327m

$71b in infrastructure spending

Inflation forecast to stay higher, for longer

Net core Crown debt hits $181b

The cost of living package targets families with young children.

For parents

=========

Two-year-olds included in 20 hours of free early childhood education from March 2024, at a cost of $1.2 billion over four years. This saves eligible parents about $133 a week. Subsidies for childcare centres rise by 5.3 per cent, costing $260 million over four years.

Public transport

=============

$327 million for free public transport for primary school-aged children, half price public transport for under 25′s from 1 July - benefiting about 774,000 people. Pay rises for bus drivers.

Health

======

Removing $5 co-payment for prescriptions, cost: $618 million over four years.

More money to help reduce waiting lists ($118 million) and $100 million to boost primary care. $63 million for 500 extra nurses. $75 million more for Pharmac.

The tax change

=============

Tax rate for trustees to increase to 39 per cent from April 2024 - the same as the top income tax rate. Aimed at stopping people using trusts for their income to avoid the higher tax rate. Expected to raise $350 million a year.

Post-cyclone infrastructure

======================

National Resilience Plan set up with initial funding of $6 billion - first priority is repair and rebuild of telecommunications, energy and roading after Auckland flooding and Cyclone Gabrielle.

Housing

========

$403 million to expand scheme for heating and insulation installations to 100,000 more homes. 3000 new public housing places.

The economy

===========

Inflation is forecast to drop to 3 per cent by next September.

Treasury no longer forecasting a recession, due to cyclone recovery. Unemployment is forecast to peak at 5.3 per cent in late 2024.

GDP is forecast at 3.2 per cent this year, dropping to 1 per cent next year.

The books

=========

Return to surplus forecast in 2025/26. Net debt is forecast to peak at 22 per cent in 2024.

The surprises

============

$34 million increase in funding for Te Matatini (over two years) - up from $3 million a year now. The festival will get more funding than the NZ Symphony Orchestra for the first time.

New 20 per cent rebate for game development studios - allowing them to claim up to $3 million a year in rebates.

================================================

www.nzherald.co.nz...

================================================

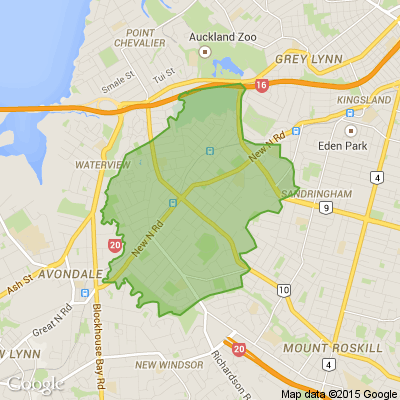

Dry cleaners mt Roskill

Hello our fellow neighbors I was hoping someone would know where the old dry cleaners we had up at the lights on dominion road have moved to?? I was out of town and when I came back they were gone .... I had some items that I would really love to get back but if only I new where they moved to or how to get In Touch with the owners to see what they did with our clothes if they closed down or moved elsewhere? Any updates or news about it would be amazing neighbors. Have a great day

Valentine’s Special | Custom Massage & Energy Healing

A 120-minute bespoke massage and energy-healing session designed to bring awareness and sensation back into the body. Ideal for a grounding, nervous-system reset, and embodied presence.

Valentine’s Special: $200 (120 minutes)

Session includes

- Intuitive, tailored full-body massage

- Integrated energy-healing work

- Premium organic massage oils

- Custom aromatherapy

- 432Hz healing frequency soundscape throughout

Why Valentine’s?

Valentine’s doesn’t have to be outward or performative. This session is a way to reconnect internally, release stored tension, and return to the body with clarity and ease.

About

Experienced professional masseuse and energy healer. Sessions are one-on-one only and adapted precisely to what the body presents on the day.

Available in Helensville, Auckland CBD, or as a mobile service.

Limited Valentine’s availability.

Message to book or enquire.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.2% For. Self-service is less frustrating and convenient.

-

43.7% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Loading…

Loading…