Food prices rose 12.5 per cent in the year to April 30, that’s the highest rate since September 1987.

Yesterday’s food price statistics were a stark reminder that Kiwis are still feeling the pain from the rising cost of living.

Despite the fact that higher interest rates are starting to bite and the economy is starting to slow, we cannot yet relax in the fight to beat inflation.

Anyone who remembers the year to September 1987 will recall the country was in a pre-sharemarket crash, inflationary investment bubble. Mortgage rates were up at eye-watering heights, close to 20 per cent.

Most economists expect the Reserve Bank will need to deliver at least one more Official Cash Rate hike on May 24, taking it to 5.5 per cent.

That will see two-year fixed rates above 7 per cent.

Clearly, we are not seeing a repeat of those 1980s excesses.

With the size of the average mortgage so much larger now (nominally and relative to income) the pain will be real.

There’s no getting around the need to rebalance the economy and pay the price for the Covid stimulus-fueled boom - albeit a boom that successfully protected us from a far more serious economic slump than the one we now face.

But there is hope that we are nearing the end of this painful part of the economic cycle.

On Thursday, markets around the world cheered the news that US consumer price inflation had cooled again - the 10th consecutive month of deceleration.

The US Consumer Price Index climbed 4.9 per cent in April from a year earlier, less than the 5 per cent that Bloomberg’s survey of economists had expected.

Stripping out volatile prices like food and oil, the core measure (that central banks tend to focus on) was an improved 5.5 per cent.

Globally, commodity prices have plunged in the past year. We are now seeing the price effects of the pandemic play through in something like the transitory manner that most economists expected.

But the flow-on through to domestic economies - as local businesses pass on costs and wages rise - is taking longer to unwind.

There was a risk that domestic inflation would spiral and become embedded. And that required central bank action.

In New Zealand, the flooding and weather events have compounded food price inflation, but there will always arise short-term issues to deal with.

Despite that the April food price index rise was not actually a shock to economists - it was in line with expectations.

It won’t have shaken the view that topline inflation has peaked.

As that food price spike plays through the numbers, we’ll be left with wages and employment as the last piece of the puzzle to fall into place.

Once we can be sure that we see the rate of inflation is on the decline, there will be scope for the self-inflicted pain of monetary tightening to be eased.

In other words, the Reserve Bank will have regained some control of the economy - until the next big global shock at least.

====================================================

www.nzherald.co.nz...

====================================================

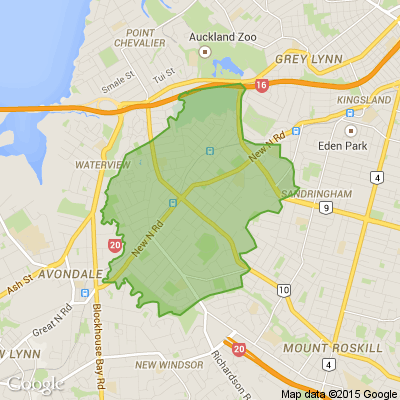

Dry cleaners mt Roskill

Hello our fellow neighbors I was hoping someone would know where the old dry cleaners we had up at the lights on dominion road have moved to?? I was out of town and when I came back they were gone .... I had some items that I would really love to get back but if only I new where they moved to or how to get In Touch with the owners to see what they did with our clothes if they closed down or moved elsewhere? Any updates or news about it would be amazing neighbors. Have a great day

Valentine’s Special | Custom Massage & Energy Healing

A 120-minute bespoke massage and energy-healing session designed to bring awareness and sensation back into the body. Ideal for a grounding, nervous-system reset, and embodied presence.

Valentine’s Special: $200 (120 minutes)

Session includes

- Intuitive, tailored full-body massage

- Integrated energy-healing work

- Premium organic massage oils

- Custom aromatherapy

- 432Hz healing frequency soundscape throughout

Why Valentine’s?

Valentine’s doesn’t have to be outward or performative. This session is a way to reconnect internally, release stored tension, and return to the body with clarity and ease.

About

Experienced professional masseuse and energy healer. Sessions are one-on-one only and adapted precisely to what the body presents on the day.

Available in Helensville, Auckland CBD, or as a mobile service.

Limited Valentine’s availability.

Message to book or enquire.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.2% For. Self-service is less frustrating and convenient.

-

43.7% I want to be able to choose.

-

47.1% Against. I want to deal with people.

Loading…

Loading…