7000 pensioners overcharged in another Inland Revenue error

Almost 7000 pensioners have been affected by another Inland Revenue error.

Last week, RNZ reported that 4500 people had overpaid tax after their imputation credits had been incorrectly recorded in their prep-populated tax returns.

Others got in touch and said they had also experienced a problem, this time with the way that NZ Super was recorded for ACC purposes.

One man said he had been charged $301.68 in ACC earner levy for $18,854.98 of gross income from NZ Super that should not have attracted a levy at all.

He said he was not able to control this when he completed his return and did not realise the error until the process was complete.

He said he did not think a lot more about it but when he saw RNZ's reporting of the other error, he realised that there had been at least two this year.

"This really starts to suggest a deficiency in change control of IRD systems."

Another couple said they wanted assurance that Inland Revenue had taken steps to stop it happening again.

======================================

Inland Revenue said 6778 people were affected.

======================================

"There was an issue identified earlier this year where we were not populating the 'earnings not liable' figure correctly for some customers. We fixed those returns for the customers in July 2025."

Chartered Accountants Australia New Zealand tax leader John Cuthbertson said ACC was not paid on NZ Super because it was not liable income.

"However, if you're working and receiving NZ Super, your earnings from that work do attract levies."

"The advancements in digitalisation and MyIR have been quite incredible, except when it goes wrong like this. You shouldn't need a Chartered Accountant to check prepopulated forms, but the average person might not know that super income does not attract ACC levies. We used to say 'google it' but many taxpayers are now using AI to do a basic check of their tax returns, asking simple questions like 'Should I pay 'x' levy on 'y' income?"

Angus Ogilvie, managing director of Generate Accounting Group, said it was concerning that issues seemed to be leading to erroneous data being prepopulated into Inland Revenue's system.

"The new software employed was a very costly and complex project. However, taxpayers should expect that there is a high level of diligence applied to get their tax obligations right. Let's hope that the department is devoting urgent resource to correct these issues".

======================================================

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.5% Yes, supporting people is important!

-

26.2% No, individuals should take responsibility

-

14.3% ... It is complicated

Lost Cat

SMOKEY

MISSING since 7th Feb 26

Grey green eyes

Very shy

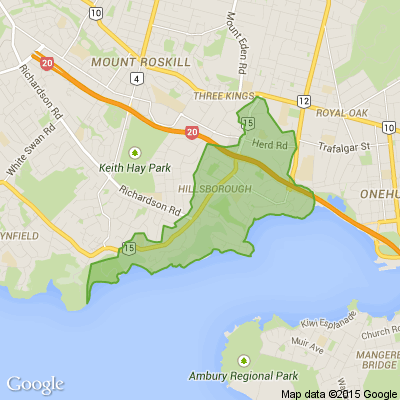

Missing from Dominion road near St Albarns church.

Jan 0274374334

Brain Teaser of the Day 🧠✨ Can You Solve It? 🤔💬

Make a hearty dish. Take just half a minute. Add four parts of kestrel. Then just add one. What have you made?

(Trev from Silverdale kindly provided this head-scratcher ... thanks, Trev!)

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Loading…

Loading…