Interest Rates: RBNZ OCR

2pm Wed 28 Feb, the RBNZ will unveil its eagerly awaited OCR decision, marking the first such announcement since 29 Nov 2023. What can we anticipate?

The RBNZ has adopted a hawkish stance, signaling potential rate hikes amidst concerns over domestic inflation - a sentiment echoed by ANZ's Chief Economist, NZ's largest bank.

Contrastingly, the majority of economists have taken a dovish position, cautioning against rate increases. They underscore the impacts of the successive rate hikes (+4.25%) over the past 2.5yrs and the softening underlying GDP, despite robust migration figures.

Adding to the complexity, our Prime Minister, Christopher Luxon, has characterized the nation's current state as "fragile."

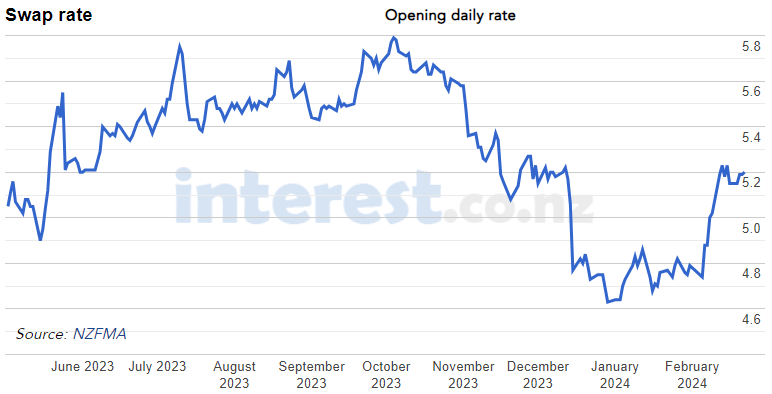

Market sentiment have been oscillating. Wholesale market funding rates experienced a -1.16% decline from 4 Oct to 29 Dec 2023, (refer to 2yr swap rate graphic). However, since then, they have rebounded, increasing +0.57%. Concurrently, retail mortgage rates have seen some reduction but not to the same extent.

Market dynamics are influenced by a plethora of factors, including local and international data releases like employment figures, inflation rates, and GDP growth. Moreover, commentary from influential figures - sometimes referred to as "jawboning" - can significantly sway market sentiment.

Ultimately, the RBNZ holds the reins, but it's far from a predetermined outcome.

If you are seeking independent guidance on your refix, restructuring, or refinancing options, reach out to adviceHQ today.

#advicehq #RBNZ #ocr #interestrates #mortgagerates

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

61.4% Yes, supporting people is important!

-

22.5% No, individuals should take responsibility

-

16.1% ... It is complicated

A Neighbourly Riddle! Don’t Overthink It… Or Do?😜

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

If you multiply this number by any other number, the answer will always be the same. What number is this?

ENGLISH CHAT GROUP 😁 Forrest Hill Church, 151 Forrest Hill Road, Forrest Hill

Join us at our English Chat Group on Monday 16th February. The morning session is 🌻 10am-12pm 😄and the evening session is 7pm- 830pm. Come to one or both, whichever suits you. Learn some new words or practise some old ones. No skill level required. Tea ☕️ & biscuits🍪 provided. A gold coin donation 🪙appreciated to cover costs, but not necessary. Everybody welcome. Bring a friend along if you wish. Laughter & fun guaranteed! 🤣🍒 See you there! Cheers Helen

Loading…

Loading…