Cost of living increases: Who is being hit hardest now?

Beneficiaries and people on NZ Super are experiencing faster increases in the cost of living, while the biggest spenders are getting some relief, new data shows.

Stats NZ has released data for the September quarter, which shows the average New Zealand household experienced a cost-of-living increase of 2.4 percent over the previous 12 months.

That is less than the 3 percent rate of inflation, because it includes a 15.4 percent drop in mortgage interest payments.

Mortgage interest payments were the main contributor to highest-spending households recording the lowest annual inflation, Stats NZ said.

Their annual inflation rate was 0.8 percent, compared with 3.9 percent for superannuitants, who are less likely to be paying mortgage interest. Beneficiaries had costs increasing 3.4 percent and the lowest-spending households had an increase in costs of 4 percent.

Rents increased 2.6 percent over the year to September. Rent makes up 29.5 percent of beneficiary household expenditure. This compares with 13.1 percent for the average household, and 5.1 percent for highest-spending households.

Council of Trade Unions policy director Craig Renney, a former adviser to then-Finance Minister Grant Robertson, said it had historically been the case that people on the lowest incomes had the highest rates of cost-of-living increases.

That had changed after Covid when home loan rates increased sharply but now the situation had reversed. He said it was likely that the impact would continue to be felt in this way.

Council of Trade Unions (NZCTU) policy director and economist Craig Renney.Craig Renney. Photo: Stuff / ROBERT KITCHIN

"Much of the challenges are in administered costs, rates, electricity, going to see the GP, which are rising faster than general inflation."

But Satish Ranchhod, a senior economist at Westpac, said it was important to note that some of the lower-income people who were experiencing higher rates of inflation would be young people in the earlier stages of their careers, who had not yet reached a point where they could buy a house.

"It's misleading to say they're getting hit, they're just at a different place in the lifecycle."

But he said times were still tough for many households, including many lower-income earners.

He said people who had mortgages had experienced large increases in recent years and a much bigger squeeze on their incomes.

The relief they were experiencing was likely to continue as the impact of falling interest rates filtered through to more people, he said.

Other significant increases were an 11.3 percent increase in electricity on average and an 8.8 percent increase in rates.

How are cost increases felt?

========================

Inflation experienced in the 12 months to the September 2025 quarter:

all households 2.4 percent

beneficiaries 3.4 percent

Māori 2.4 percent

superannuitants 3.9 percent

highest-expenditure household group 0.8 percent

lowest-expenditure household group 4 percent.

===================================================

Poll: 🤖 What skills do you think give a CV the ultimate edge in a robot-filled workplace?

The Reserve Bank has shared some pretty blunt advice: there’s no such thing as a “safe” job anymore 🛟😑

Robots are stepping into repetitive roles in factories, plants and warehouses. AI is taking care of the admin tasks that once filled many mid-level office jobs.

We want to know: As the world evolves, what skills do you think give a CV the ultimate edge in a robot-filled workplace?

Want to read more? The Press has you covered!

-

52.7% Human-centred experience and communication

-

14.7% Critical thinking

-

29.6% Resilience and adaptability

-

2.9% Other - I will share below!

Room for rent

🌿 Beautiful Private Space Available for Rent – Perfect for 2 Girls or a Couple 🌿

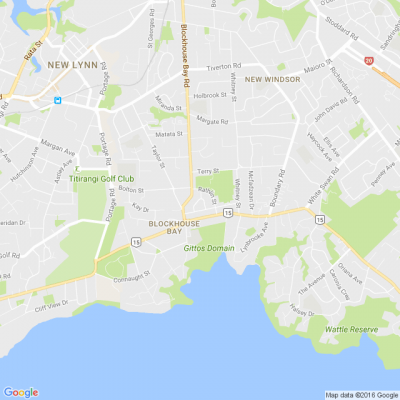

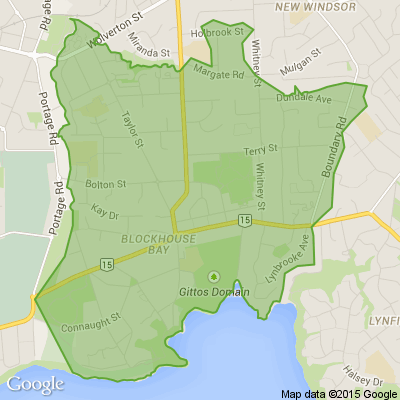

Located in the peaceful and family-friendly suburb of Lynfield, this warm and welcoming home offers a comfortable living space in a highly sought-after top school zone.

✨ What’s Included:

🏡 2 Spacious Bedrooms

🛁 Private Bathroom

🍳 Separate Kitchen

🛏️ 1 Bed with Mattress

🔥 Stove

📟 Microwave

Unlimited WiFi included

✔ Power & water included

✔ Bus stop in front of the house

✔ Nearby shops and supermarkets

This setup is ideal for two girls or a couple looking for a quiet, safe, and relaxed place to call home.

🌸 Enjoy living in a serene neighbourhood with a friendly community atmosphere, while still being conveniently close to schools, shops, and transport.

If you're looking for comfort, privacy, and a peaceful lifestyle — this could be your perfect new home 💛

📍 Location: Lynfield, Auckland

📩 Message for more details or to arrange a viewing. For couple $450 for one bedroom. $600 for the 2 bedroom and kitchen and bathroom. Feel free to contact me on 022-422-0145 for any other details

Wills and Luxon are screwing the country to please the oil and gas industry.

Today the smart investment is in battery peaker plants in combination with solar and wind, or with any other renewable generation capacity during low demand times.

Gas is expensive and will get more so over time.

Let's not forget that Nicola Willis' dad is a big time oil and gas investor, lobbyist, and industry insider.

Maybe this should be posted in ‚Crime & Safety‘?

Loading…

Loading…