HELP MY BANK WILL NOT ASSIST MY BUSINESS WITH FUNDS

Even in normal times Banks in NZ reject 60% of Business applications primarily because firstly your business risk profile does not pass Bank standards (the % is probably higher than 60% at present) or that the borrower has misrepresented the financial status of the business to the bank concerned. A lot of the above is also because you do not have equity in residential property sufficient to secure your borrowings.

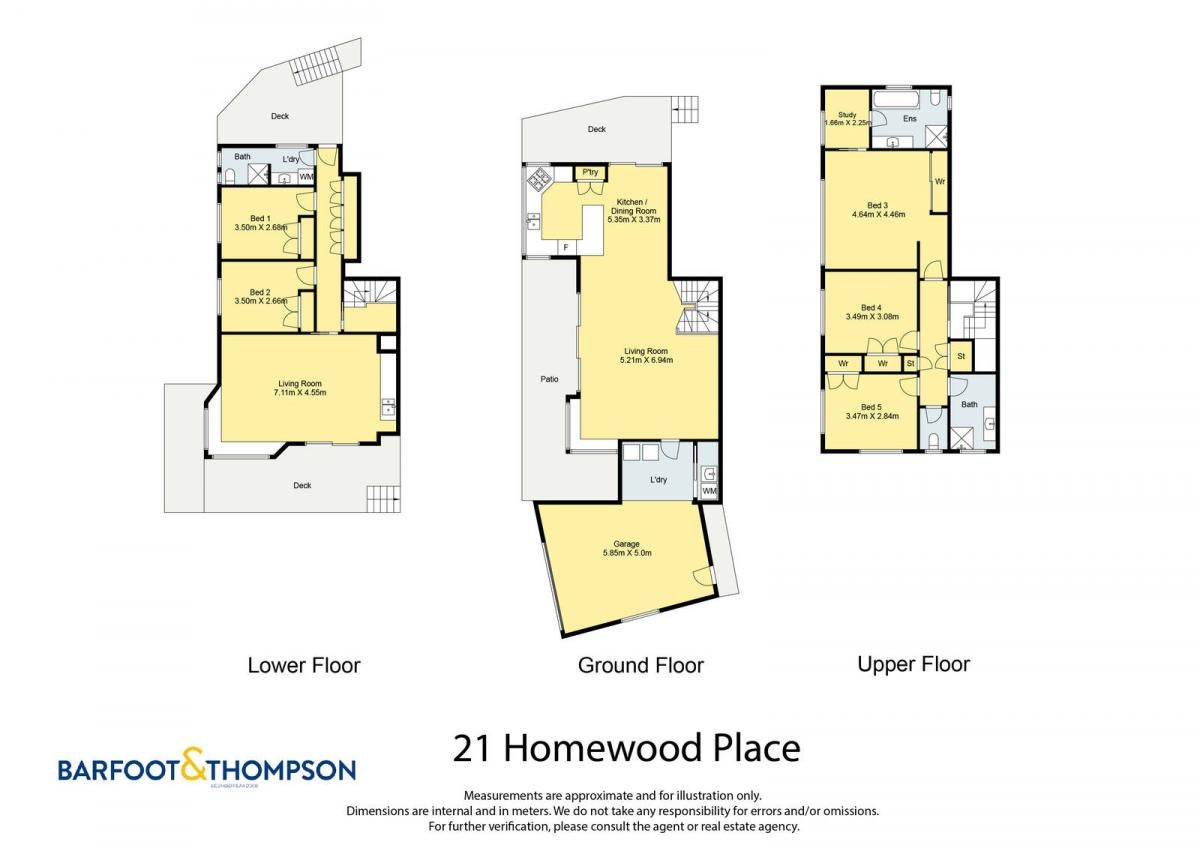

If you have residential property security available we can arrange 12 month loans at 8.5% p.a. PLUS a Lenders Loan Establishment Fee of 2% max = Total Lenders cost of 10.5% which can be renewed annually and is repaid by way of monthly Principal and Interest payments. The Banks operating in NZ as shown at interest.co.nz total charges stretched from a low of 12.1% p.a. lowest to 20.15% p.a.

Note the lowest Bank Loan/Overdraft rate assumes that they only take a interest rate margin of 1% out of what they say is their spread choice of 1% to 5% which I have never ever seen from a Bank in NZ and Australia since 1976.

Our Lender of choice can also switch-hit to Invoice Discounting - which is far more expensive on the surface than using residential property to secure the lower rates shown above. Only one Bank in NZ can switch hit being the BNZ but your credit sales p.a. have to exceed $3.5 M nzd.

The advantage of using Invoice Discounting is two fold, Firstly despite the cost it super charges your cashflow and secondly the resultant liability from selling invoices to the Lender is that the debt is extinguished when payment of the invoice is made by the customer.

Rick 0204-0203663 rick.otavicpartners@gmail.com

FERN LOGO The Final One for Neighbourly 22nd October 2020 .pdf.pdf Download View

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.5% Yes, supporting people is important!

-

26.2% No, individuals should take responsibility

-

14.3% ... It is complicated

Brain Teaser of the Day 🧠✨ Can You Solve It? 🤔💬

Make a hearty dish. Take just half a minute. Add four parts of kestrel. Then just add one. What have you made?

(Trev from Silverdale kindly provided this head-scratcher ... thanks, Trev!)

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Nominations are officially open for the 2026 Westfield Local Heroes program

Know someone in your community who is driving positive change?

Westfield is inviting you to nominate your local hero online.

The successful hero for each New Zealand Westfield destination will be awarded a $20,000 grant for the organisation or group they represent, and each finalist will receive a $5,000 grant for their organisation or group.

Find out more about the program and nominate your Local Hero now

Loading…

Loading…