Thousands of households in arrears on council rates

Rates have been rising quickly in many parts of the country in recent years.

When Stats NZ released consumer price index (CPI) data for the September quarter last week, it noted that rates were up 8.8 percent year-on-year.

That was lower than the 12.2 percent increase in the September 2024 quarter, but higher than the average increase of around 7.3 percent observed between 2018 and 2025.

Auckland Council's head of rates, valuations and data management, Rhonwen Heath, said 6.6 percent of rates, or 42,902 households were outstanding at the start of the 2025/2026 year.

"For the previous two years, 5.4 percent of rates were unpaid. Four years ago in 2022/2023, 8.2 percent of rates were outstanding.

"Throughout the year, reminder letters, follow-up calls and emails are issued to assist customers. Ratepayers can catch-up on any outstanding rates at any time during the rating year."

Wellington City Council said 7825 ratepayers were in arrears at the end of September, or 9.3 percent. They owed a total $39 million. In 2021, 7302 ratepayers had been in arrears, or 9.05 percent.

In Christchurch, 2.98 percent of properties had rates arrears, compared to 3 percent in 2021.

David Verry, a financial mentor at North Harbour Budgeting Services said before Covid, budget services rarely saw clients who had mortgages.

But as interest rates rose, that had started to change. Many households struggled with large home loan debt they had taken on while rates were low, he said.

"Whilst they were struggling to meet the fortnightly repayments, alongside all the other expenses, it was things like the rates bill that tipped them completely over the edge. This would have been common amongst the budgeting services.

"From what I've seen, rates increases across the country have been well above the rate of inflation ...Where there haven't been commensurate increases in incomes then things like the rates increases will tip people over the edge when budgets are tight. And things like insurance premiums may have also gone up too…along with electricity prices and the other cost of living increases."

He said it was not uncommon to see councils taking action under the Property Law Act to force a bank to pay rates and add the money to a mortgage.

It was something that was highlighted in Massey University's recent retirement expenditure guidelines.

Research lead Associate Professor Claire Matthews said rates were a growing problem for retired households.

She said some of the arrears could be a protest vote against council while others were because people could not afford them.

Jake Lilley, spokesperson for Fincap, the network that supports financial mentors, said rates and power costs were difficult for people on fixed incomes.

"The numbers in our Voices reports continue to show more homeowners presenting for assistance with financial mentors each year. We've seen a 38.7 percent increase in the proportion of debt listings where local government is the creditor between 2021 and 2024. However, the median amount of these debts has reduced to $1098 between 2023 and 2024.

"The data also captures dog registrations, parking infringements, library fines, and unpaid noise complaint fines and other local government debts as well as rates.

"Financial mentors have commented on lack of clarity and inconsistencies between different councils, which makes dealing with debt to council especially challenging. We've made recommendations to include debt to local government in the debt to government framework, and to ensure that there are effective hardship support policies at councils."

=====================================================

Time to Tickle Your Thinker 🧠

If a zookeeper had 100 pairs of animals in her zoo, and two pairs of babies are born for each one of the original animals, then (sadly) 23 animals don’t survive, how many animals do you have left in total?

Do you think you know the answer? Simply 'Like' this post and we'll post the answer in the comments below at 2pm on the day!

Want to stop seeing these in your newsfeed? No worries! Simply head here and click once on the Following button.

Poll: As a customer, what do you think about automation?

The Press investigates the growing reliance on your unpaid labour.

Automation (or the “unpaid shift”) is often described as efficient ... but it tends to benefit employers more than consumers.

We want to know: What do you think about automation?

Are you for, or against?

-

9.5% For. Self-service is less frustrating and convenient.

-

43.3% I want to be able to choose.

-

47.2% Against. I want to deal with people.

Freehold, renovated, future potential

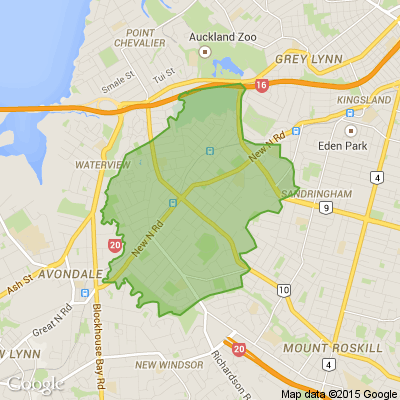

Hi everyone, we thought we’d share this here in case you, or someone you know, is looking for a lovely 2-bedroom freehold home in Blockhouse Bay. This has been our investment property for many years, and we’ve recently put a lot of care into preparing it for its next owners, including a brand-new kitchen, new flooring, and fresh paint inside and out. Set on a freehold section of around 560m², it offers a generous lawn, a new veggie garden, and future potential to add a cabin or sleepout. We truly hope it becomes a place where new memories are made.

For viewings, please contact Piyush and Manali Setia at Ray White Blockhouse Bay - 021 2363 854:

rwblockhousebay.co.nz...

Loading…

Loading…