ACC May Owe You a Refund if between 2002 - 2017 you were self employed or paid provisional ACC Levies.

Sorry for this really long message. If after the first paragraph you work out it does not apply to you, you may want to skip the rest. It sounded important so I thought I should pass it on.

Are you owed a refund?

If you were in your first year of self-employment between 2002 and 2017, or paid provisional ACC levies after ceasing trading, ACC may owe you a refund.

ACC expects to refund around $100 million to approximately 300,000 business customers who were incorrectly charged levies during that time.

ACC will refund:

all first-year levies collected between 2002-2017 from self-employed customers who worked full-time (averaged over 30 hours per week over the financial year.) This affects around 106,000 customers and equates to approximately $36 million in levies.

businesses who paid provisional invoices and weren’t required to do so because they’d subsequently ceased trading or had changed their business structure. This amounts to around $64 million.

The average refund works out at about $340 (excluding GST) for first-year self-employed, and around $415 (excluding GST) for provisional payments. Customers will also receive an interest payment.

ACC expects the refund process to be completed by 31 March 2019.

What you need to do

If you think you might be eligible for a refund, ACC needs your current contact details.

Either visit acc.co.nz and fill in a web form with your contact details, or if you’re already registered for MyACC for Business, use that channel to check your contact details are up-to-date.

ACC will update their webpage as more details become available.

ACC website (external link)

How did this happen?

An update to ACC’s billing and policy system identified these issues.

Preparations for a new levy system included a legal check on whether the new levy system would be compliant with regulations. ACC discovered the regulations from 2002 were drafted in a way that didn’t allow for levying of first-year self-employed.

They also uncovered the second issue with provisional invoices paid by businesses that had subsequently ceased trading or changed their business structure, but hadn’t informed ACC.

ACC suspended invoicing new self-employed customers for their first year when the issue was uncovered. No first-year invoices have been issued since March 2017, and this will continue until the regulations are updated.

“I would like to apologise to customers who have been affected, our focus now is to make this right as soon as we can,” says Phil Riley, ACC’s Head of Business Customer Service Delivery.

Do you have more questions about ACC levy refunds?

Do you have more questions about ACC levy refunds?

Visit acc.co.nz for more information, phone 0800 222 776, or email business@acc.co.nz.

Poll: Should the government levy industries that contribute to financial hardship?

As reported in the Post, there’s a $30 million funding gap in financial mentoring. This has led to services closing and mentors stepping in unpaid just to keep helping people in need 🪙💰🪙

One proposed solution? Small levies on industries that profit from financial hardship — like banks, casinos, and similar companies.

So we want to hear what you think:

Should the government ask these industries to contribute?

-

59.3% Yes, supporting people is important!

-

26.2% No, individuals should take responsibility

-

14.5% ... It is complicated

Have you got New Zealand's best shed? Show us and win!

Once again, Resene and NZ Gardener are on the hunt for New Zealand’s best shed! Send in the photos and the stories behind your man caves, she sheds, clever upcycled spaces, potty potting sheds and colourful chicken coops. The Resene Shed of the Year 2026 winner receives $1000 Resene ColorShop voucher, a $908 large Vegepod Starter Pack and a one-year subscription to NZ Gardener. To enter, tell us in writing (no more than 500 words) why your garden shed is New Zealand’s best, and send up to five high-quality photos by email to mailbox@nzgardener.co.nz. Entries close February 23, 2026.

Pet Sitting Available

Hello Everyone

Thank you for looking at my profile.

I am a local mum who is mature, reliable, responsible, and hardworking. I have a 6 year-old, our pet cats are called Ruby and Iggy. I work as a Teacher Aide when I'm not pet-sitting.

I have been pet-sitting since December of 2022, I love animals. I am motivated to provide a friendly and genuine service for my customers and build positive relationships between clients of the human kind and the four-legged kind :D.

I am patient and caring, eager to work with all animals and breeds, and willing to walk animals in their normal environments. My skills include attention to detail, orderly and organised.

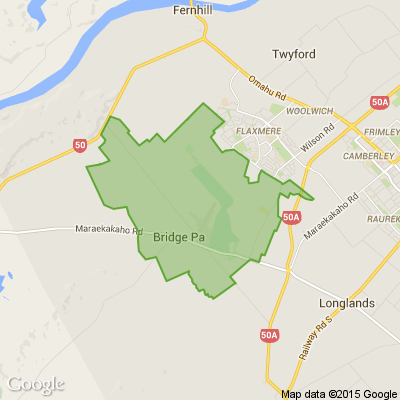

I live in Hastings but am willing to travel locally.

Pay rates for one animal (additional animals can be discussed)

Services:

One home visit per day NZD $20

Two home visits per day NZD $25

The duties I can offer are:

*Home visits (while you are away)

*Feed, water, and walk animals according to schedule and feeding times.

*Can mix food, liquid formulas, medications, etc. according to the instructions.

*Happy to groom pets if needed.

*Happy to clean animal's habitats

*Keep a safe environment for the pets in my care.

*Report to owners on how your beloved pets are doing.

*Examine and observe animals to detect illness, disease or injury signs.

Please feel free to contact me and ask questions or queries.

I look forward to hearing from you.

DOG WALKING AVAILABLE WITH PET SITTING.

Need a pet sitter? Check out my profile on Pawshake: www.pawshake.co.nz...

Loading…

Loading…